They call it “FOMO”: Fear of Missing Out. It’s a disease that afflicts too many investors, and causes massive (and completely unnecessary) capital loss.

It happens when a stock rockets upwards and heads to the top, creating wealth for those who got in early, but leaving others with an uneasy feeling that they missed out on those huge gains.

What happens next? As you might have guessed – and unfortunately, you may have experienced this yourself – the FOMO takes over and some investors take a long position after the big run-up. At that point, they’re risking a lot of downside for a little bit of upside, thereby taking on a poor risk-to-reward ratio and putting their hard-earned capital at serious risk.

This FOMO phenomenon claims many victims and causes plenty of grief for investors who arrive late and end up selling for a loss.

FOMO can be avoided with the right mindset and a ton of research, which is exactly what the team at Crush the Street brings you on a regular basis.

The research is a necessary piece of the puzzle because it enables us to know where we are in the cycle: early, mid-stage, or late. The idea, of course, is to get in early and ride the train to its profitable destination.

With the “No FOMO” motto in mind, I’d like to reveal my newest portfolio allocation to you. It’s in the technology sector, but it’s not Intel, Google, or Micron. There’s nothing wrong with those companies, but to truly be “no FOMO,” you’ve got to get involved with a company that isn’t a blue-chip yet, but has the potential to be one in the near future.

For this ground-floor opportunity, I homed in on a sector that is currently making waves not only in the tech sector but in the economy at large: artificial intelligence, also called AI or machine learning. It’s a burgeoning industry that has a massive influence but is nowhere near the FOMO stage; in fact, I would say it’s an undervalued and not-fully-appreciated sector of the economy.

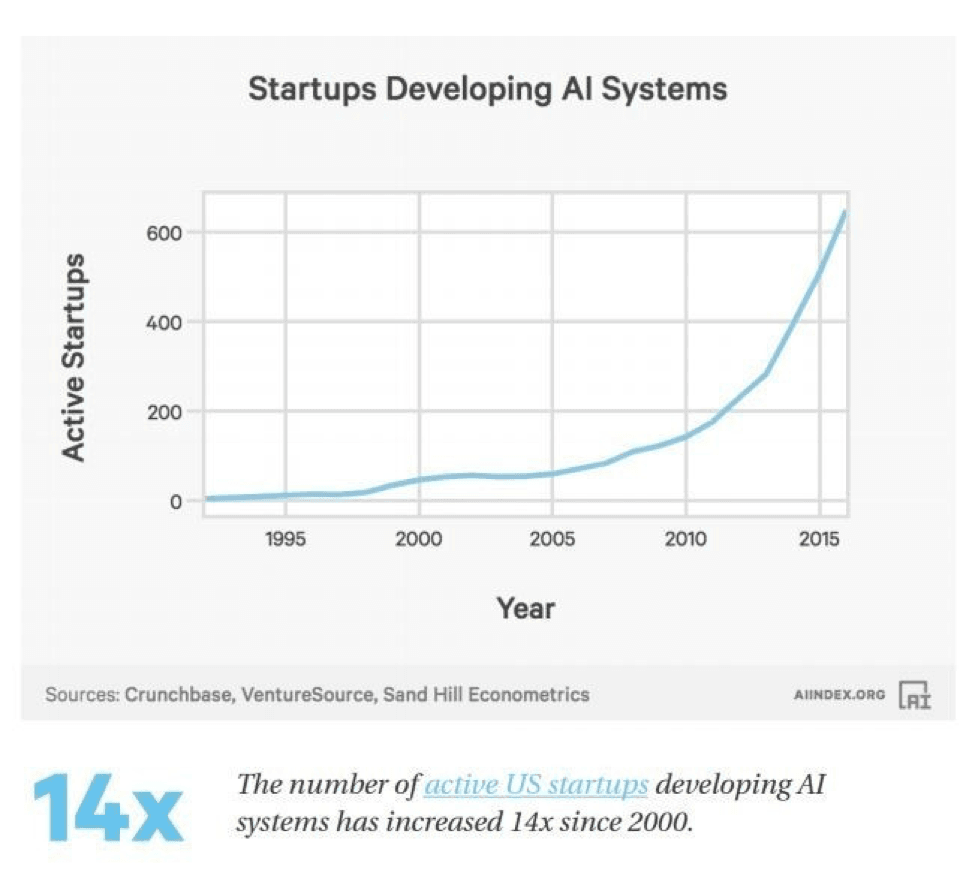

Take the following chart as a case in point:

Courtesy of Crunchbase, VentureSource, Sand Hill Econometrics

Since the year 2000, there has been a 14-fold increase in the number of active U.S. start-ups developing AI systems. The rise of the machines is already under way, and it’s a growing phenomenon year after year. Exponential growth should continue in 2018 and beyond as machine learning continues to make inroads into our businesses as well as our homes.

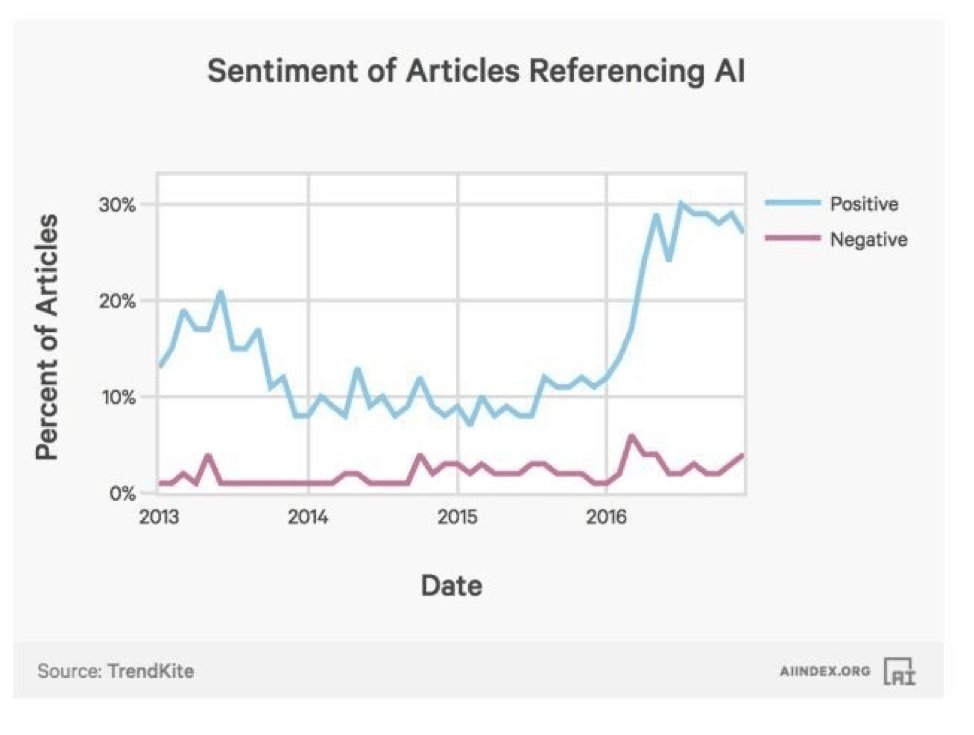

Although the FOMO phase isn’t here yet for the AI sector, people are finally starting to take notice and give artificial intelligence its due respect. There was a time when sentiment in the media was mixed towards AI, but as we can discern in the following chart, the tide of sentiment has shifted towards the overwhelmingly positive:

Courtesy of TrendKite

These positive trends are bound to increase exponentially in the coming weeks and months, and the window of opportunity won’t be open forever.

As a result, I consulted with Brad Robbins of Pure Blockchain Wealth, who has released his own report on this topic at PureBlockchainWealth.com/live, and we narrowed the field to one perfect company in the AI space.

That company is Globalive Technology (TSX-V: LIVE, OTC: LVVEF), the only true AI pure-play investment we could identify.

Recent joint ventures with leaders in technology and commerce, such as CoinSquare and Flexiti Financial, have given Globalive a leg up on the competition. Already a strong competitor, Globalive’s alliances with such strong business partners is what convinced me to take a big position in this company – all upside, no FOMO.

My full exclusive report on profiting from AI technology and Globalive is available for you right now at CrushTheStreet.com/live.

Legal Notice: This work is based on public filings, current events, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.

The ideas, projections and views expressed are those of CrushTheStreet.com and are not ideas, views or recommendations of Globalive or any of its officers or directors. Any forward looking statements are based on our assumptions, projections, beliefs and expectations, however, there is no guarantee that these statements will prove to be correct and are subject to risks and uncertainties.

This work refers to joint ventures or investments that Globalive is a party to. Some of the joint ventures may be subject to further negotiation or documentation.

Never base any decision off of our emails. CrushTheStreet.com stock profiles are intended to be stock ideas, NOT recommendations. The ideas we present are high risk and you can lose your entire investment, we are not stock pickers, market timers, investment advisers, and you should not base any investment decision off our website, emails, videos, or anything we publish. Please do your own research before investing. It is crucial that you at least look at current public filings and read the latest press releases. Information contained in this profile was extracted from current documents filed with the public, the company web site and other publicly available sources deemed reliable. Never base any investment decision from information contained in our website or emails or any or our publications. Our report is not intended to be, nor should it be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell securities, or as a recommendation to purchase anything. This publication may provide the addresses or contain hyperlinks to websites; we disclaim any responsibility for the content of any such other websites. We have entered into a three year agreement directly with the company. We plan to purchase shares on the open market as a long-term holding, we have also been compensated eight hundred thousand dollars, eight hundred thousand options, and been given one million nine hundred thousand RSUs. Please use our site as a place to get ideas. Enjoy our videos and news analysis, but never make an investment decision off of anything we say. Please review our entire disclaimer at CrushTheStreet.com.