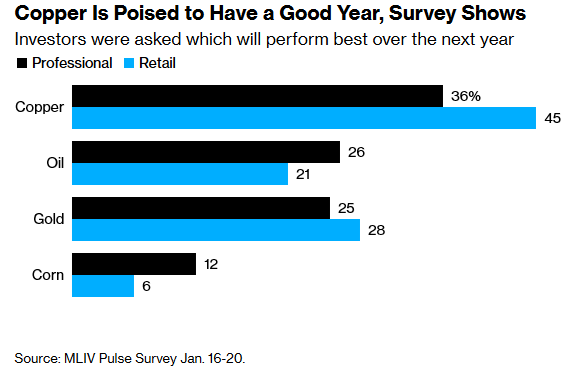

In April 2019, I published Part 1 (Twitter thread) to explore a copper supply shortage on the horizon. The price of copper subsequently rallied 75% to its most recent high in March 2022. CME Group copper futures on the COMEX rallied this winter after a pullback last spring and summer and a brief consolidation in the fall. The expected shortage scenario coming to fruition and China’s reopening of its economy this winter are contributing factors to copper’s rally this month. A survey published by Bloomberg this week found that investors anticipate copper to be a top-performing commodity in 2023.

Investors Are Bullish on Oil, But They Like Copper Even More… “Time for some commodity reflation? The price of various industrial commodities cooled off in the second half of 2022. But they’ve been picking up again lately, and investors see higher prices in the future… Retail traders, in particular, are even more bullish than their professional counterparts… A barrel of West Texas oil is currently around $80, down from over $120 in the middle of last year. All that being said, investors are even more bullish on copper than they are on oil.” – Bloomberg MLIV Pulse Survey, Jan. 23, 2023

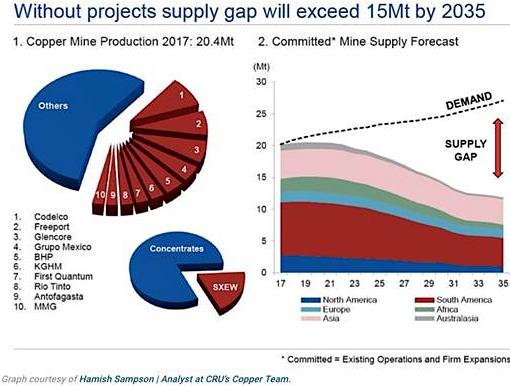

Here is an excerpt and pie chart from the 2019 analysis:

“The supply of copper doubled between 1994 and 2014. Production peaked in around 2012 and has fallen sharply ever since. The supply deficit in 2019 is projected to be much larger than 2018, and the estimated gap between supply and demand will continue growing until at least 2035… The source of new supply is currently concentrated in just five mining operations: Escondida (the highest-producing copper mine in the world), Cobre Panama, Quebrada Blanca 2, Spence, and Kamoto. Combined, the production from those mines will be responsible for 80% of the global supply through 2022.”

Copper Supply Gap Through to 2035

Copper is in everything all around us. It makes reading the words on your electronic device of choice via an Internet connection possible. The expansion of electric power and modern telecommunication requires an ever-increasing amount of copper and other materials. Traditional industries like plumbing and construction are a given, but electricity is the pillar of a greenie transition to alternative energy sources that require a huge amount of copper.

It’s projected that by 2035, the demand for copper will have doubled to meet the needs of consumer electronics and “clean energy” projects that include growth industries such as manufacturing electric vehicles, battery storage, and solar panel installation. That kind of progress requires extensive upgrades to existing power grids across the global energy sector for the next two decades at a minimum. According to a revised IEA report from March 2022, the demand for copper and rare earth elements is projected to surge by at least 40%, nickel and cobalt by 60-70%, and lithium by almost 90%.

Extremely Tight Market Could Push Copper Prices To Record Highs… “Copper prices have strongly rebounded in recent weeks, thanks to the reopening in China, which is expected to spur additional demand, and to the long-term bullishness of the market for metals necessary for the energy transition. Copper prices are set for a new record-high in 2023 amid an ‘extremely’ tight market, Goldman Sachs said last month. ‘The sequential increase in policy targets and commitments to green transition, alongside a minimal supply response so far… have resulted in earlier and larger open-ended deficit conditions that essentially are already here, not beginning at some point in the future,’ Nicholas Snowdon, metals strategist at Goldman Sachs, said in December, as carried by Financial Review. Moreover, mining and commodities giant Glencore said in an investor update last month that a huge shortage of copper is looming, reiterating warnings from other industry players and analysts that a supply crunch could slow the energy transition.” – OilPrice.com, Jan. 23

A passive vehicle to invest in copper miners is an ETF instead of diving into copper futures. The following three ETFs have direct exposure to the copper mining market. They’re sorted by average daily volume:

- Global X Copper Miners ($COPX) – Apr. 17, 2019 Close: $23.49 / Today: $41.50

- United States Copper Index Fund, LP ($CPER) – $18.57 / $25.84

- iPath Bloomberg Copper Subindex Total Return ($JJC) – $45.38 / $21.61

If you prefer to invest or trade individual copper mining stocks, extra due diligence is required before putting your capital to work. Mining operations are businesses that are located throughout the world. An investor or trader should take into consideration the technical analysis of a company’s stock chart, its executive team, financial health, all-in sustaining costs (AISC) per unit of weight mined, production capacity, and any geopolitical or local issues that may impact a mining operation and its stock price. A prescient example is Glencore’s Antapaccay copper mine in Peru that suspended its operations three times this month. Protesters are attacking the mine amid political and social unrest taking place across the country. And don’t rely on artificial intelligence (OpenAI) or chatbots for an answer because they don’t know where the world’s copper comes from and will provide you with pictures of the Great Depression.

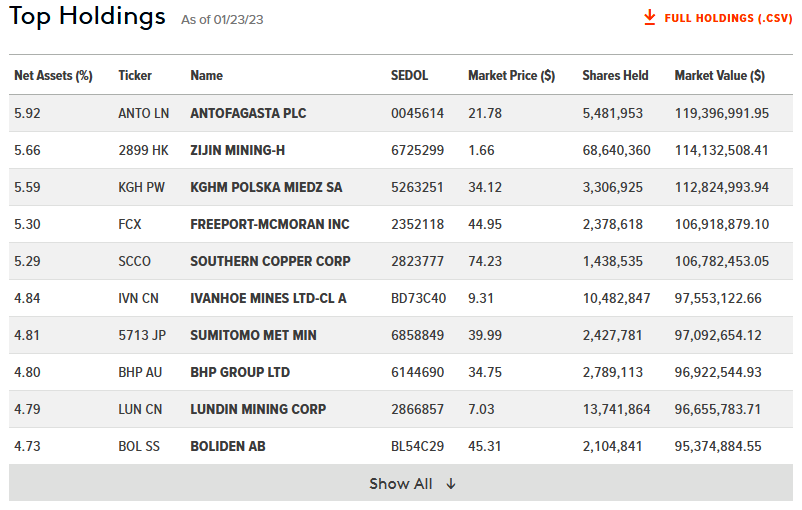

The basket of holdings in $COPX is a good place to start your watch list search. Here are the top 10 of 48 holdings ordered by market value as of Jan. 23, 2023:

The following companies are considered the copper industry’s top mining stocks. They’re sorted by average daily volume:

- Freeport-McMoRan Inc. ($FCX)

- Hudbay Minerals Inc. ($HBM)

- BHP Group Ltd. ($BHP)

- Rio Tinto PLC ($RIO)

- Teck Resources Ltd. ($TECK)

- Southern Copper Corp. ($SCCO)

Copper futures seasonality…

COMEX Copper Futures monthly chart as of Jan. 24, 2023 close…

The following video about Rio Tinto’s Resolution Copper mine in Arizona that is under development 1.3 miles underground demonstrates the difficulty and expense of bringing new production online for the global supply chain.

Plan Your Trade, Trade Your Plan

TraderStef on Twitter, Gettr / Website: TraderStef.com

Headline Collage Art by TraderStef