The airlines industry could be in big trouble. Qantas Airways Ltd. (OTCMKTS: QUBSF) recently made an announcement that it had rejected the remaining eight A380s it had on order from Airbus Group SE (OTCMKTS:EADSY). The reason for the cancellation is demand, namely, that Qantas’ present fleet is enough to meet their customers’ requirements. That may be a shrewd — or necessary — business move for Qantas, but the implications for the airliners is quite negative.

First, this is terrible news for Airbus. Years ago, Qantas was one of the first buyers of the giant, double-decker A380. It also looked at the time that repeat business was virtually guaranteed. There was much initial excitement surrounding the Boeing Co. (NYSE:BA) rival, and airliners couldn’t get enough. Fast forward to the present, multiple companies have either pushed back or cancelled their orders. Even Qantas has been delaying their purchases over the past two years.

As expected, the financial markets have been unkind to Airbus. EADSY stock is down nearly 16.5% for the year. But it’s not just a matter of statistical loss. Since mid-March, EADSY has been trending in a negatively-tilted broadening wedge pattern. According to standard technical analysis, such a pattern represents a high-probability of a reversal.

But I think investors in this case will need to apply fundamental analysis for a clearer picture. Previous “wedges” in EADSY stock have not resulted in a positive breakout beyond the prior high. That means that reversals have occurred, but the dominant trend is still negative. Fundamentally, the same pessimism applies for the airliners. They’ve had a great run in the recent past, but like any opportunity, bullishness can’t go on indefinitely.

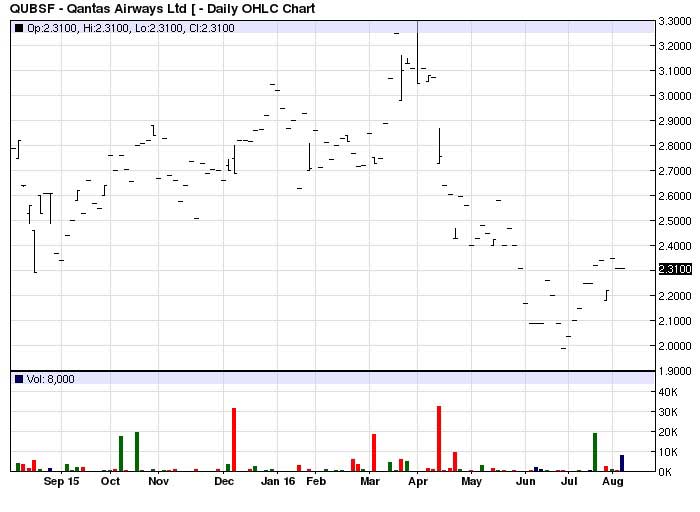

A cursory look at Qantas shares gives you virtually all of the confirmation you need to know. Year-to-date, shares are down more than 23% in its native Australian market. Even more telling, in the trailing ten-year period, Qantas is only up 3.6%. There’s not too many fund managers out there — let alone lay investors — that are satisfied with annualized gains of less than 1%.

The problem stems from a poor consumer sentiment index. Government agencies love to play fast and loose with economic data. However, all the distortions in the world can’t convince people to open their wallets en masse.

That fact has forced consolidation among the airliners. No longer can an army of individual companies compete profitably in this arena. Instead, the mergers we’ve seen within the industry are a matter of survival. Even then, the situation looks quite poor.

Qantas’ rejection is really just reiterating what insiders have known for years.