The U.S. benchmark coal index has rallied a stunning 755% after an $18.50 low in the fall of 2020, printing a $140 high during the first week of June 2022. The majority of that gain is attributed to the “Accumulation Phase in the Commodity Bull Market” analyses that I published in February of this year. Here is an excerpt from that article and a link to Jeff Currie’s interview on Bloomberg Markets:

“Jeff Currie is the global head of commodities research at Goldman Sachs Group Inc. His opening salvo pointed to stretched valuations in the equity market, a convexity in bonds at a high level alongside record dislocations and ‘structural deficits’ in asset markets such as energy, metals, and agriculture despite tons of capital sloshing around that’s looking for somewhere to go. A ‘Russian invasion of Ukraine would only heighten the geopolitical premium in prices’ and investment positions in real assets remain relatively low in financial markets. Goldman Sachs advised their clientele in 2021 that the world is entering a new commodity supercycle and is the best place to invest right now.” – TraderStef

U.S. Benchmark Coal Price by Region via NASDAQ & EIA – Jun. 10, 2022

The following videos from last week are a European perspective on coal and energy via a BBC report from South Africa, a view from Alan Jones in the land down under on Europe’s return to coal and Australia’s electricity shortage, and Hawaii’s KHON2 News mulls over the imminent closure of their only coal-fired power plant.

A new buzz phrase resonating inside the marble walls where politicos roam is a newfound love of “energy security.” Nobody cares about the climate thingy when your constituents require energy to stay warm or cool and keep the economy afloat, otherwise, the plebeians will hunt you down with pitchforks and fire if you fail to provide an affordable and consistent energy supply. Sri Lanka’s collapse in the last two months and violence over food and fuel prices that brought Ecuador to a standstill this week are examples of what can happen when a population has had enough.

Two forms of energy that were at the bottom of the greenies’ agenda are climbing back to the top. There are nuclear power plants with existing infrastructure and for practical reasons, and then there’s affordable coal when abundant supply and a coal-fired power plant are ready to roll.

Japan to restart idled nuclear power plants, no plans to replace… “Japan will take firm steps to restart idled nuclear power plants to make maximum use of nuclear power to stabilize energy prices and supply, Prime Minister Fumio Kishida said on Friday.” – Reuters, May 26

Germany to fire up idle coal stations as Russia squeezes gas supply… “Germany must reduce natural gas consumption and increase the burning of coal in order to help fill gas storage facilities for next winter… ‘The situation is serious… we are therefore continuing to strengthen precautions and taking additional measures… gas consumption must fall further, but more gas must be put into the storage facilities, otherwise things will really get tight in winter’… Despite Germany’s plans to exit coal-fueled energy production, Habeck, who is a Green Party politician in the center-left ruling coalition, announced a return to ‘coal-fired power plants for a transitional period’” – CNN, Jun. 19

Czech ambassador…“‘If there is a gas cut out this winter, we will burn anything we can to keep our people warm and to make electricity,’ he said. ‘We don’t know whether we will be able to move in the timeframe we agreed on in Versailles in March of this year to phase out Russian oil and gas and everything else by 2027. Or whether Russia will shut out gas before the winter, during the winter or at any other time.’” – Euractiv, Jun. 21

In the meantime, Europe is scrambling to secure natural gas supplies to help ween them off of Russian pipelines. Those new contracts are wrought with long-term commitments.

Buyers Scramble To Lock In Long Term LNG Contracts In 2022… “The volume of long-term LNG contracts signed to end-user markets climbed to a 5-year high in 2021. 10-year LNG contracts are currently priced at ~75% above 2021’s rate. Bloomberg data shows that LNG demand is outstripping supply after Russia’s invasion of Ukraine… The Ukraine crisis, the energy transition, severe weather, and surging demand are creating a period of upheaval that is tightening supply like never before in the natural gas industry. Credit Suisse has estimated that the global LNG market could be short nearly 100 million tons per year by the middle of the decade if the world moves to cut Russian gas… In Europe, French multinational utility Engie SA has signed up to 1.75 million tpy for 15 years from NextDecade’s Rio Grande project, a project that will use carbon capture and storage (CCS) to reduce its emission footprint.” – OilPrice.com – Jun 23

A reduced gas supply is trashing Europe’s economy, and politicians are in a panic. E.U. leaders are having a meeting about a meeting in Brussels this weekend to discuss solutions. Germany is the strongest economy in Europe, and its economic contagion is spreading quickly due to a history of incompetent energy policies and blowback from a failed sanctions regime against Russia.

Reduced Russian Gas Grips Germany… “Russia has supplied around 60% less gas than requested by Germany which has knock on effects for other countries within the euro zone as alternative supply remains sparse. German Economy Minister Robert Habeck warned that some industries may have to shut down in the winter if Russian supply remains at current levels… Earlier this week the German Minister raised the ‘alarm stage’ to a level where soon gas companies will be able to pass on higher energy costs directly to consumers.” – DailyFX, Jun. 24

Germany Pushes for G-7 Reversal on Fossil Fuels in Climate Blow… “Germany is pushing for the Group of Seven (G7) nations to walk back a commitment that would halt the financing of overseas fossil fuel projects by the end of the year, according to people familiar with the matter. That would be a major reversal on tackling climate change as Russia’s war in Ukraine upends access to energy supplies.” – Bloomberg, Jun. 25

A solution is right under their nose that includes coal and/or nuclear. According to the International Energy Agency (IEA), spending on coal projects around the globe is expected to soar by 10% in 2022. Numerous countries are searching for investments and energy supply alternatives as the NATO proxy war with Russia over Ukraine continues with no hope of peace on the immediate horizon.

“In some markets, energy security concerns and high prices are prompting higher investment in fossil fuel supplies, most notably on coal.” – Fatih Birol, IEA Executive Director

I explored an idea that “Regenerative Agriculture is a Pollution Solution Instead of Bankrupting the Coal and Livestock Industry” in Dec. 2019. Here is an excerpt:

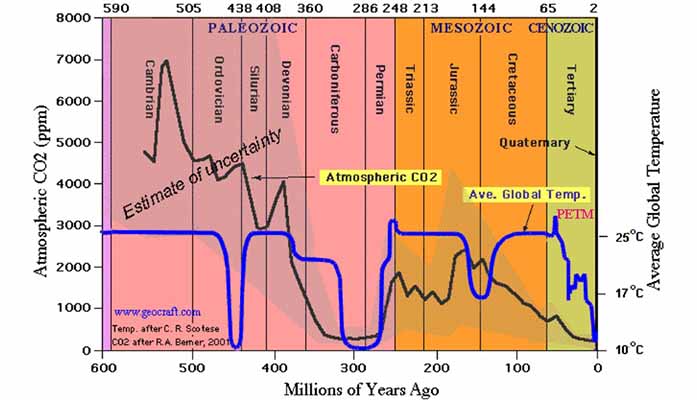

“It is imperative to first differentiate what pollution is vs. CO2. The level of carbon dioxide is one cog in a complex climate story and a healthy gas that is necessary for the planet. Human survival relies on it. There is no correlation between carbon dioxide levels and the warming or cooling of Earth, but the big ball of fire in the sky is the primary driver of Earth’s climate and we cannot do much about that, much less think that fleecing the population with a carbon tax scheme can save a planet or solve an underappreciated issue… Before I elaborate further, you should acknowledge the existence of a political agenda that gives funding and fuel to pseudoscience and stokes eco-pocalyptic propaganda resulting in global warming fear that morphed into a climate change meme to rationalize the fraud, as meteorological models have proved it false, in addition to several incidents of manipulated data from official governmental agencies. How dare you! “ –TraderStef, Dec. 2019

Examination Of The Relationship Between Temperature & C02 – Arizona Independent, May 2017

The mainstream media is not covering the efforts being made in Wyoming to build clean coal plant alternatives that sequester pollutants and carbon dioxide for other industrial uses. Keeping the economic engine running requires jobs, and the coal industry is no exception.

A solution to keep coal going in Wyoming… “As seven US-based coal companies went broke between 2018 and 2019… a project called the Integrated Test Center is very close to opening the 385-megawatt Dry Fork Station operated by Basin Electric Power Cooperative in Wyoming… ‘Currently, Wyoming produces more than 40% of the nation’s thermal coal. This coal production provides high-paying jobs for our Wyoming families and pays for our schools, our roads and our state and local government. Many of our communities rely almost entirely on coal production’ … ITC provides space for researchers to test, in a real-life setting, carbon capture, utilization and sequestration technologies… where carbon dioxide molecules can be pulled and utilized. The idea is for them to come up with solutions to use the captured CO2 for other purposes such as fertilizers, fish food, building materials, concrete, and plastic products.” – Mining.com, Nov. 2019

CO2 storage project in America’s coal country one step closer to becoming a reality… “A second deep test well for site characterization is being drilled near Basin Electric’s Dry Fork Station near Gillette, in Wyoming, where the CarbonSAFE program is working to determine the suitability of the underground geological formations for commercial-scale carbon dioxide storage.” – Mining.com, Jan, 2022

In the U.S., a full-blown energy crisis with rampant inflation is bringing grassroots activists back to energy policy reality, but the politicos on Capitol Hill remain in fantasy land.

The shift to green energy, obstructed… “A whole host of factors has thrown the transition away from fossil fuels to more sustainable forms of energy off track… the supply chain crisis, inflation, geopolitics…To fill the electricity void left by diminishing hydropower supplies (drought) and rising heat-related demand, utilities have little choice but to turn to power generated by burning natural gas… That extra demand for natural gas, in turn, causes the price to increase, which then makes coal more cost-competitive… In 2021, after a decade of decline, coal consumption shot back up to 2019 levels. Arch, the huge energy corporation that owns mines in the Powder River Basin and western Colorado, says it expects to sell even more of the stuff in 2022.” – High Country News, Jun. 9

Common sense is the basic level of practical knowledge and judgment that we all need to live in a reasonable and safe way. Published in 1776 by Thomas Paine, his book “Common Sense,” challenged the authority of the British government and the royal monarchy. The plain language that Paine used spoke to the common people of America and was the first work to openly ask for independence from Great Britain. The U.S. needs to work on independence from New Green Deal extremists and proceed with a balanced, slow, and steady approach that doesn’t destroy the socioeconomic fabric of a nation and the world. The war in Europe is not going away anytime soon, and we must all come to our senses.

Ukraine Resistance Collapsing, Economic Crisis Wrack Europe, UK’s Johnson about to Fall… “People need to understand, that all of this is now irretrievably and forever lost – the limit of Russia demands towards Ukraine. I think that there is still far too much magical thinking, inability to understand the deteriorating situation and the extent to which proposals which might have been entertained and might have been considered on a genuine basis for discussion a few weeks or months ago have now been overtaken by events. The lack of understanding or failures to grasp realities is also illustrated by the extraordinary decision to grant Ukraine candidate status in the European Union. In and of itself it means absolutely nothing. Turkey has had candidate status to join what is now known as the EU ever since 1964. Putting that aside, it does not even remotely begin to address the real problems at the moment. Ukraine is losing the war, tens of thousands of people are dying, there’s an economic crisis across the West, and all the leaders of the West seem to do is come together to hold discussions about granting Ukraine candidate status for the EU. It’s not tokenism or symbolism, it’s just an extraordinary theatrical performance that’s held in a theater where no one is watching. Why would anyone be interested in that now when Ukraine is in the process of being destroyed. Some people in the West have grasped the realities.” – Alexander Mercouris Podcast at TheDuran, Jun. 24

Companies in the U.S. are not benefiting as much from the coal price spike since other nations source the bulk of their imports from other countries and not the U.S.

Analysis: U.S. coal companies struggle to cash in on Europe crunch… “The United States, which holds the world’s biggest reserves of coal, is unlikely to play a major role in international efforts to expand shipments of the fuel to Europe ahead of an expected European Union ban on Russian imports this August to punish Moscow for the invasion. It also means the rally in global coal prices is unlikely to pull the U.S. coal industry out of a more than decade-long tailspin driven by federal and state efforts to slash carbon emissions that have led utilities to replace coal with cleaner-burning natural gas, and solar and wind power. Ernie Thrasher, chief executive of Xcoal Energy & Resources, a coal marketer, estimated that bans on Russian coal could remove 114 million tons a year from global markets, but that the United States would be poised to fill less than a tenth of that given the lack of investment in the U.S. industry. ‘That’s really the issue,’ said Thrasher. ‘There’s been virtually no capital invested in the industry since 2015,’ he said adding Europe was likely to rely most heavily on other countries like Colombia, Indonesia, South Africa, and Australia to replace Russian coal.” – Reuters, May 17

Despite the gloomy outlook from legacy media, the charts for companies based in the U.S. coal industry are worth a look. Conduct your due diligence and add your favorite to a watchlist. The following stocks are listed in order from the highest to lowest in daily trading volume.

- Nasdaq U.S. Benchmark Coal Index

- $DJUSCL – Dow Jones U.S. Coal Index

- $BTU – Peabody Energy Corp.

- $METC – Ramaco Resources, Inc.

- $HCC – Warrior Met Coal, Inc.

- $CEIX – Consol Energy Inc.

- $HNRG – Hallador Energy Company

- $NC – Nacco Industries, Inc.

- $ARLP – Alliance Resource Partners

Plan Your Trade, Trade Your Plan

TraderStef on Twitter, Gettr / Website: TraderStef.com

Headline Collage Art by TraderStef