Amidst a volatile environment rife with geopolitical turmoil, commodity market fluctuations, and a general sense of unease, the benchmark S&P 500 finally showed signs of pricing in the negativity of “real-time” conditions. Since peaking on the first day of trading in March, the index is down -2.4%. Year-to-date, investors are up only four-tenths of a percent, hardly the ringing endorsement of a domestic economy in recovery. As such, many have turned to emerging markets, specifically funds that track the performance of a basket of foreign equities. Since the beginning of the year until now, popular exchange traded funds such as Vanguard FTSE Emerging Markets ETF (VWO) and iShares MSCI Emerging Markets ETF (EEM) are each up approximately 3.5%.

As can be expected, the most recent survey of market investors conducted by Societe Generale indicated that 61% of respondents were bullish towards the emerging market sector. However, a sharp decline in sentiment for that sector’s investment potential was noticed amongst hedge fund managers. Societe Generale went on to state:

“This is all the more true for the medium-term (three-month) outlook, on which hedge funds are now outright bearish. There is a major divergence of views between hedge funds and real money investors, with the latter remaining solidly bullish over three months (66.7% of total). In terms of positioning, EM investors have marginally curtailed their risk positions compared with February, especially on the hedge fund side The overall positioning index declined to +0.72, reflecting a moderate bias towards bullish risk taking.

The technical picture has weakened compared to February, notably reflecting the negative impact of real-money investors. In fact, the majority of real-money investors now feel over- invested, which is bad news for the market’s technical position.”

(DeFotis, Dimitra. “Hedge Funds More Bearish On Emerging Markets. Barron’s. April 2, 2015. Web.).

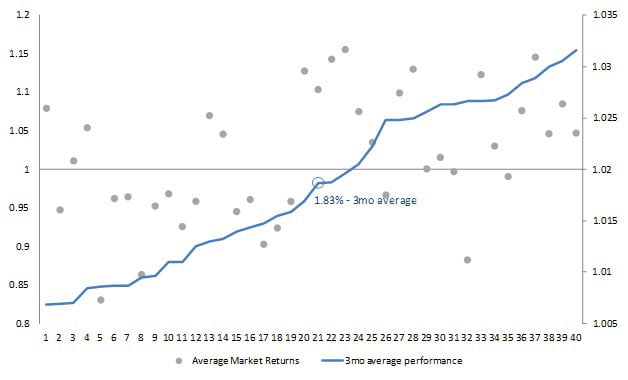

The split narrative between “real money” investors and hedge funds is particularly noteworthy due to the profitability potential of emerging market funds. Using VWO as an example and incorporating the above “medium-term” time frame, the average performance of this ETF over the past three months is 1.83%. Given this condition, the probability that VWO will rally over the next three months is 55%, for an average gain of 7.71% per the below chart:

Real money investors are likely to jump on any opportunity where the odds are in their favor. The same can be said for the hedge fund manager, of course, but their particular approach to the emerging markets hides a subtlety that may be missed by casual observers. Despite the current probabilities, advanced investors may note that for VWO in particular, lower monthly averages beget significantly lower odds of future (near-term) profitability. What the technical charts show for several emerging market funds, including VWO, is that their best run — at least for the interim — may be behind them. The fact that the investors with the finest research tools and complex algorithmic trading systems are lowering their exposure to this sector is another confirming indicator that emerging markets may be a fool’s bet.

There may still be money to be made in foreign markets: no one is suggesting a correction tomorrow. However, the polarizing effect that this subject has created certainly warrants a higher degree of caution.