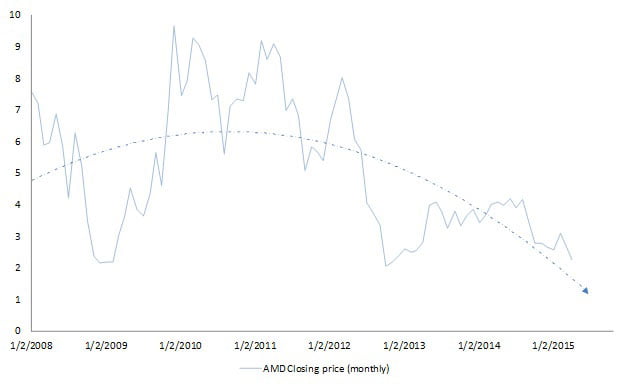

The trials and pitfalls that is the defining theme of Advanced Micro Devices, Inc. (NYSE:AMD) continues to compound Wall Street, with some analysts calling for an overdue recovery. The argument for an “upside correction” is a fairly logical one: because financial markets are cyclical in nature, it’s time for AMD stock to get some payback. More appropriately termed contrarianism, these investors buy when others are selling, and sell when others are buying. In some cases, this reverse-psychology has been profitable, and in all cases, it’s considered sexy, but for AMD, it’s just plain stupid.

AMD Stock

Don’t get me wrong: AMD stock has proven at times to be a great swing-trade, something that I had discussed earlier through CrushTheStreet.com. However, unless one is armed with insider information, there are three major headwinds that have stymied Advanced Micro Devices in their recent history:

• The microprocessor company is simply in the wrong business. Revenue for the PC category is declining severely, meaning that upside potential for all competitors in the field is shrinking. Naturally, this would affect the weakest players — hello AMD! — and cost-cutting can only go so far. At some point, income growth will have to be a key talking point and seriously: how does one do that with a capped ceiling?

• Historically, AMD has poor earnings results, which says a lot considering how feebly the stock has performed in the markets. Expectations and consensus targets have been lowered by Wall Street, yet the company has financially underperformed over the last four quarters. They could turn things around come mid-July when their next earnings report is released, but at this point, should serious investors even bother?

• Statistically, AMD stock is a poor candidate for a near-term rebound. It streaked quite impressively in February, but the bears responded with consecutive months of steep selloffs. As a result, its average performance over the past 90 days is -2.83%. Using this metric as a control, the implied probability that AMD stock will trade higher by its next earnings report is a lowly 35%.

In addition, top credit agencies are not buying the comeback story. Moody’s recently lowered its outlook for AMD, citing the high potential of the company running operating losses and negative free cash-flow. Zacks Equity Research ranks AMD stock as a “strong sell,” the worst rating that they give.

But isn’t this the heart of contrarianism? To have courage when others are fearful? In a word, no. Being a contrarian is not about simply reversing the decision made by other people: it’s having the basis to do so. But in the case of AMD, there’s no basis to be bullish for an appreciable length of time. They are a weak company in a weak industry and projected by many smart people to become weaker still.

Buying AMD isn’t a contrarian move: it’s an ignorant one.