The major U.S. stock market indices have had an exceptional rally since the Federal Reserve’s FOMC meeting in Nov. 2023 when the committee membership and Chairman Jay Powell puked a buffet of dovish monetary policy Fedspeak. At the Dec. 13 meeting, they delivered the #TaperCaper with a “Fed pivot” and murmurings of an end to quantitative tightening (QT), a recession on the horizon, and a new dot plot graph that foresaw slashing interest rates by mid-2024. There were only 13 stocks (5 of the “Magnificent Seven”) that accounted for nearly 100% of the S&P 500’s gain year-to-date. Here are a few excerpts from the “Dow, Nasdaq, S&P, and Russell 2023 Close – Technical Analysis” published on Dec. 30:

“Two business days after publishing a bearish late fall analysis on Oct. 29 and one day following ‘The Federal Reserve at War’ article in the Wall Street Journal, an FOMC monetary policy announcement on Nov. 1 was dovish enough to launch a wicked rally to remember where ‘everyone got burned.’” – TraderStef

Forget the S&P 500. Pay attention to the S&P 493 – The Economist, Nov. 8

Magnificent Seven vs. S&P 493 – The Economist

Will it be all about the Magnificent Seven again in 2024?… “A well-documented aspect of the 2023 stock market rally was how seven large technology stocks — Apple (AAPL), Alphabet (GOOGL, GOOG), Microsoft (MSFT), Amazon (AMZN), Facebook (META), Tesla (TSLA), and and microchip manufacturer Nvidia (NVDA) — drove most of the market’s gains. But in the final two months of the year, the rally broadened out, and many strategists see that market breadth continuing in 2024.” – Yahoo Finance, Dec. 30

Despite news on Jan. 29 that Elon Musk’s Neuralink project implanted its first brain chip into a human while “terrified fans warned the first cyborg is born” and the WSJ penned “Neuralink Wants to Make ‘The Matrix’ a Reality,” stocks in the Magnificent Seven technology family that’s populated by utopian artificial intelligence dreams devoid of human labor experienced an overdue plunge on less-than-stellar earnings reports yesterday.

AI companies lose $190 billion in market cap after Alphabet and Microsoft report… “AI-related companies lost $190 billion in stock market value late on Tuesday after Microsoft, Alphabet, and Advanced Micro Devices delivered quarterly results that failed to impress investors who had sent their stocks soaring. The selloff following the tech giants’ reports after the bell underscored investors’ elevated expectations following an AI-fueled stock market rally in recent months that propelled their shares to record highs with the promise of incorporating the technology across the corporate landscape.” – Reuters, Jan. 30

Fear not because we’re on the heels of a WW3 escalation in the Middle East, global shipping supply chains face major disruptions due to Houthi missiles on behalf of Hamas, the Fed’s favorite leading economic indicators (LEI) are in the longest losing streak since the collapse of Lehman Brothers, manufacturing data points are printing numbers in line with previous recessions, downward revisions to skewed employment reports amid massive tech layoffs are the norm, the huge increase in government hiring is signaling a recession, a residential housing bubble is on the verge of deflating, commercial real estate is crashing, there’s bipolar consumer confidence amid a credit card shopping spree with personal savings back to 2009 levels, bankruptcy filings are surging, the U.S. national debt is out of control with no budget deal from Capitol Hill, the Biden administration has enabled a southern border invasion since 2021, and “Bidenomics is so bad that it’s a punchline, but Americans aren’t laughing anymore.” Thus, this week’s FOMC gray suits agreed to leave interest rates unchanged today for plebeians, and “the Committee does not expect it will be appropriate (to cut rates) until it has gained greater confidence that inflation is moving sustainably to 2%.”

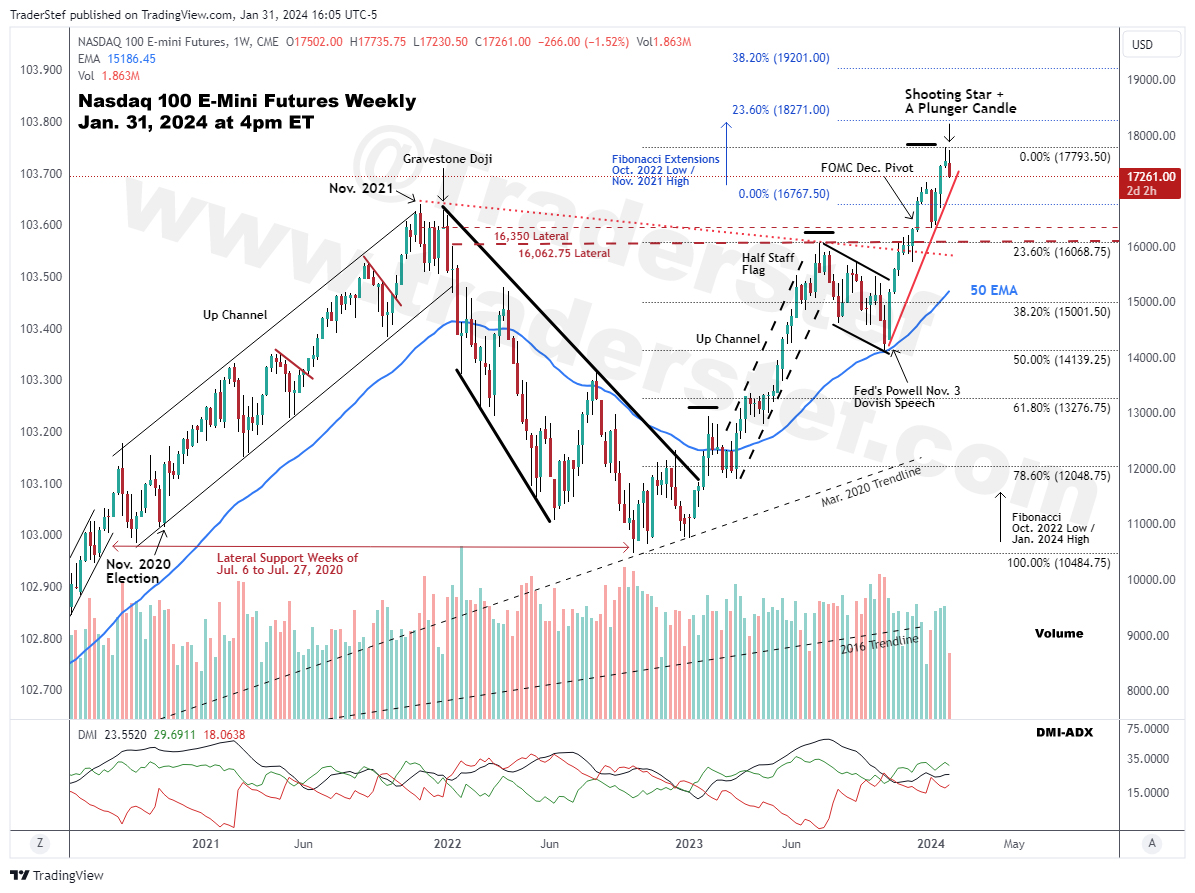

Today’s FOMC decision combined with Jay Powell’s comments at the presser delivered enough Fedspeak to initially spike stock indices upward and then whipsaw them back to Earth before the NYSE closed at 4pm ET. Let’s move on to the Nasdaq 100 chart and see what happened since the new year started. Note that a technical analysis with a weekly candlestick chart focuses on potential near-term (a few weeks) trading opportunities for short-term swings or intraday scalps. To view a larger version of the following chart, mouse over it and select or right-click it and choose a “view image” option.

$NDQ Nasdaq 100 E-Mini Futures ($NQ1) weekly chart as of Jan. 31, 2024 at 4pm ET…

Excerpt from “A.I.-Related Stocks Are Bubbling the Nasdaq – Technical Analysis” May 2023:

“Do you own any Nvidia stock? If you were fortunate to have purchased a substantial core position at $5 per share in 2003 and forgot about it, you’re sitting pretty 20 years later. $NVDA has rallied 182% since the first day of trading in 2023 after it printed a $419 high yesterday.”

Excerpt from the “Dow, Nasdaq, S&P, and Russell 2023 Close” Dec. 2023 weekly chart analysis:

“The bullish Half Staff Flag was confirmed in this rally since the 16,063 lateral and trendline drawn down from the 2021 high were decisively taken out. The subsequent price spike printed an all-time high of 17,165 this past week, which is just shy of a 21.5% gain over 9 weeks from the 14,140 low in late October. This week’s Plunger Candle (aka Shooting Star) at the close signals the potential for a pullback. Support is around the 16,063 lateral and trendline drawn down from the Nov. 2021 high. The Nasdaq futures closed for the week at 17,023. The DMI-ADX is in the early stage of a bullish Alligator Tongue power trend but hesitating while it digests the recent price spike that’s extended well above the 50 Exponential Moving Average (EMA). Buy Volume remains strong and was much lower over the past week. There could be profit-taking and a breather on the horizon. The chart is bullish, and caution is warranted in the near term.”

After a Plunger Candle printed a high of 17,165 in the last week of Dec. 2023 and closed at 17,023, an expected pullback totaled 705 points with a close at 16,460 in the first week of January. That low is the second price point on the lower red trendline since the week of Oct. 30. Last week’s high printed a Shooting Star with a 17,793 high and 17,527 close. A Plunger Candle is taking hold this week and closed at 17,239 at the NYSE 4pm close today. Support is found at the red trendline, 16,767 at a lateral drawn from the Nov. 2021 high for Fibonacci extensions, 6,350 lateral at early January lows, 16,063 lateral drawn from mid-July 2023 at the Half Staff Flag high, and a fluent price point at the 50 EMA. The next target for a new high is the 23.6% Fibonacci extension level at 18,271.

All the major stock indices took a hit today during and after the FOMC presser. The Nasdaq’s DMI-ADX is still positive but unremarkable vs. a solid power trend setup. The current market is for professional traders that scalp or swing the dips and rallies, not passive retail investors seeking core positions to buy and hold. The chart is neutral in a world full of financial chaos and war.

Jim Rickards: Put on Your Crash Helmets – New Banking Meltdown Could Snowball, U.S. Economy – Daniela Cambone at ITM Trading, Jan. 19, 2024

Plan Your Trade, Trade Your Plan

TraderStef on Twitter, Gettr / Website: TraderStef.com