Do you own any Nvidia stock? If you were fortunate to have purchased a substantial core position at $5 per share in 2003 and forgot about it, you’re sitting pretty 20 years later. $NVDA has rallied 182% since the first day of trading in 2023 after it printed a $419 high yesterday. Congratulations if you keep one eye on the stock market and were astute enough to take some hefty profit off the table. The daily chart printed a bearish Shooting Star (aka Plunger Candle) yesterday and closed at $378 on the NYSE at 4pm today. The stock’s 30% spike last week on a strong earnings report is indicative of a lot riding on the A.I. hype with its GPU microchips and entire artificial intelligence stack that’s positioned well ahead of competitors. When a stock trades at nearly 50x probable earnings and 40x its book value, will the automated machines and human traders continue to chase it?

Here’s why it’s the clear winner in the AI race so far… “According to tech strategist Ted Mortonson ‘they have the entire AI silicon stack. And those are basically three components. They have the most advanced GPU, they have advanced networking embedded in the silicon, advanced memory embedded, and they’re now developing a new CPU.’ In other words, Nvidia is a one-stop shop for what companies need to drive their AI ambitions. They control their entire ecosystem, on both the hardware and software side, similar to Apple with its iPhone and iOS system. ‘When you cobble all these things together, it is an integrated immensely powerful AI engine. And they are years ahead of anyone else,’ Mortonson said, highlighting Nvidia’s software development of CUDA, which is far ahead of its closest competition.” – Markets Insider, May 29

The buzzword that launched a tech rally this year is generative artificial intelligence. I penned “The A.I. Freak Show Requires Your Obedience and Capital” in February along with its ongoing Twitter thread. Here’s an excerpt from the article:

“The A.I. freak show is commonplace among people’s daily lives whether they realize it or not and invaded the public’s fingertips last November with the now popular ChatGPT chatbot operated by OpenAI. It’s backed by Microsoft and has been rated the fastest-growing consumer app in history. Plebeians can now experiment and explore A.I. capabilities firsthand via a smartphone, tablet, or desktop PC. Both Alphabet (Google) and Microsoft pointed to the shift to A.I. as one of their biggest challenges when they announced restructuring plans last month. As a side note, Google has reported that its DeepMind is close to achieving ‘human-level’ artificial intelligence and OpenAI’s co-founder Ilya Sutskever said today’s largest neural networks are ‘slightly conscious.’ How one can be artificial and human simultaneously is a misnomer. The current environment of the industry includes but is not limited to artificial neural networks, cyborg technology, digital image processing, generative AI, humanoid robots, machine learning, natural language processing (NLP), predictive AI, and industrial robotics.”

A market cannot sustain a melt-up on the rally of a few because advances in the technology sector are the result of a handful of stocks. With recession (Twitter thread) knocking on the door, it doesn’t take a genius to figure out that securing some profit and sitting on the sidelines with dry powder is a wise choice. Here are three video clips to consider from pundits in the financial press:

David Rosenberg: A.I. boom could collapse like 1990s dot-com – CNBC, May 25

Microsoft ‘just getting started’ in A.I., others are positioned – CNBC Power Lunch, May 26

Amazon Web Service could be biggest winner from A.I. demand – CNBC, May 26

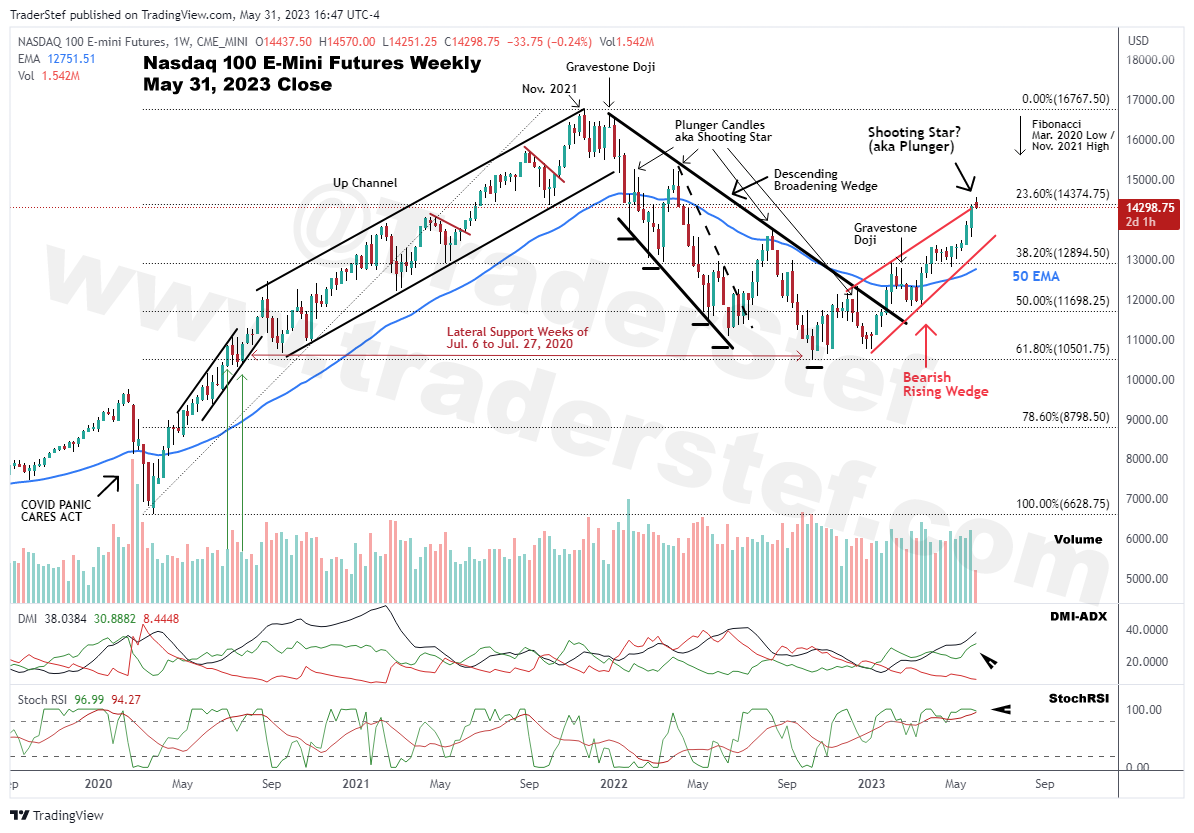

Let’s move on to a watch list of A.I.-related equities and ETFs to consider and a technical analysis of the Nasdaq 100 weekly chart to see what happened since the March 6 analyses. Note that a weekly chart provides a window into the future for a couple of weeks or sometimes longer. Always reevaluate charts on a daily basis. Fibonacci retrace levels are not definitive price points and should only be used to identify potential resistance and support areas not indicated by other trendlines and studies. My personal preference is that a stock must have a steady trading volume with no dead minutes and roughly 1 million shares traded on an intraday basis to ensure ample liquidity for trading large positions. The last issue you want, regardless of the time horizon, is to be stuck in a block of shares with no liquidity and a bid/ask flow giving you the middle finger while trying to close (or add) positions. Lastly, identify patterns and studies that are indicative of a near-term rise in price. The following watch list is sorted by high-to-low average volume. To view a larger version of the Nasdaq chart, mouse over it and select or right-click on it and choose a “view image” option.

ETFs:

- BOTZ – Global X Robotics & Artificial Intelligence

- IYW – iShares U.S. Technology

- FTEC – Fidelity MSCI Information Technology Index

- IXN – iShares Global Tech

- ROBO – Robo Global Robotics and Automation Index

- XT – iShares Exponential Technologies

- AIQ – Global X Artificial Intelligence & Technology

- IRBO – iShares Robotics and Artificial Intelligence Multisector

- ROBT – First Trust Nasdaq Artificial Intelligence and Robotics

- IGM – iShares Expanded Tech Sector

- UBOT – Daily Robotics, AI & Automation

- QTUM – Defiance Quantum

- THNQ – Robo Global Artificial Intelligence

Company Stocks:

- AMZN – Amazon, Inc.

- AAPL – Apple Inc.

- PLTR – Palantir Technologies Inc.

- NVDA – NVIDIA Corporation

- INTC – Intel Corporation

- MSFT – Microsoft Corporation

- GOOG – Alphabet Inc.

- AI – C3.ai, Inc.

- MU – Micron Technology, Inc.

- MRVL – Marvell Technology, Inc.

- TSM – Taiwan Semiconductor Manufacturing

- SMH – VanEck Semiconductor ETF

- AVGO – Broadcom Inc.

- AMKR – Amkor Technology, Inc.

- ON – ON Semiconductor Corporation

$NDX Nasdaq 100 E-Mini Futures weekly chart as of May 31, 2023, at 4pm ET…

Excerpt from the Mar. 6, 2023 weekly chart analysis:

“The NDX consolidated during the first week of January, then rallied above the Descending Broadening Wedge’s topside trendline and 50 EMA to a 12,950 high in early February. That upside move was followed by a bearish Gravestone Doji. Last week’s price action printed a low of 11,832 and closed on the 50 Exponential Moving Average (EMA) at 12,311. Momentum did not follow through today, and the price remained stuck on the 50 EMA. Near-term support rests at the 50% Fibonacci and overhead resistance is clear at the 38.2% Fibonacci. The DMI-ADX is positive but indecisive, the StochRSI is in overbought territory, and Volume is steady. The chart remains neutral and a scalping environment for professional traders.”

Price action on the NDX has rallied from a 10,485 low in October 2022 to a 14,750 high yesterday. After the March analysis, consolidation took place for four weeks beginning in late February through early March before breaking above the 50 EMA. A subsequent rally to the 38.2% Fibonacci level occurred on falling buy volume, which led to a second consolidation through April on steady buy volume. The May rally has run into resistance at the 23.6% Fibonacci this week with two trading days left. Thus far, this week’s candlestick is a potential Plunger Candle that’s resting on the topside trendline of a bearish Rising Wedge.

The DMI-ADX indicates a strong uptrend is intact, but the StochRSI has been in overbought territory for three months. Buy volume was solid and steady until last week, but this week is much lower and trending on the sell side. If the price action breaks out on strong buy volume above the 23.6% Fibonacci, there’s not much resistance until the January and March highs in 2022 at around 15,280. If the price breaks down from here, the first levels of support are the 38.2% Fibonacci and 50 EMA. The chart is neutral despite the recent rally and a scalping environment for professional traders.

If you haven’t had the opportunity, I suggest you watch the following mini documentary that I co-produced with CrushTheStreet.com 5 years ago.

AI: The Greatest Job Disruptor in History Now – CTS

Plan Your Trade, Trade Your Plan

TraderStef on Twitter, Gettr / Website: TraderStef.com

Headline Collage Art by TraderStef