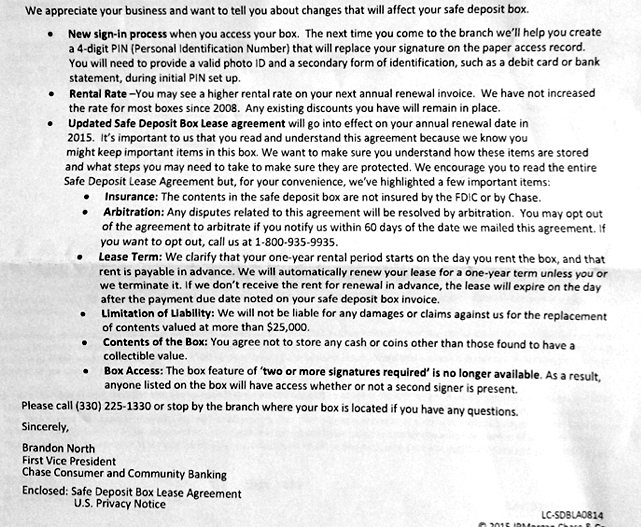

The banks’ war on cash has ventured beyond everyday transactions at many of the nation’s largest banking institutions and crept into your sacrosanct safe deposit box. Not only is your cash unwelcome, but your gold and silver bullion or coin, sentimental family heirlooms, and jewelry not appraised as a collectibles are becoming bastardized assets. In early 2015, the first hint of safe deposit box prohibitions appeared in form letters delivered to Chase customers.

“You agree not to store any cash or coins other than those found to have a collectible value.”

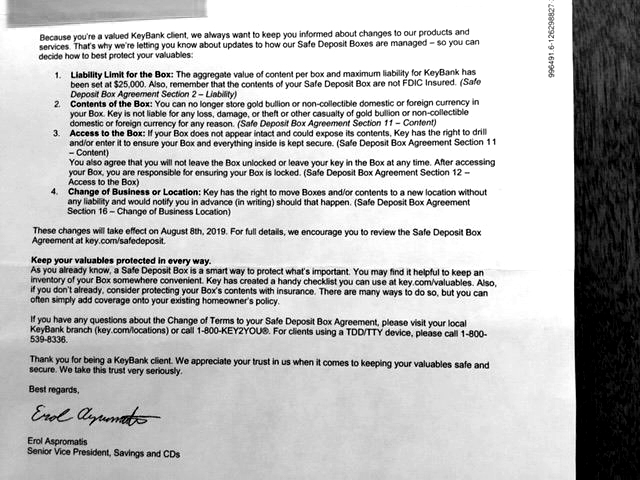

The banking industry at large appears to be following the leaders. Here is a notification to KeyBank customers in 2019:

“You can no longer store gold bullion or non-collectable domestic or foreign currency… KeyBank has the right to move Boxes and/or contents to a new location without any liability.”

Source: David Collum

Of particular interest in the KeyBank notice is the inclusion of a “no liability” clause if your safe deposit box is moved to a new location. That is not a surprise since the contents of a safe deposit box do not fall under FDIC insurance if they are damaged or stolen. A safe deposit box is a leased storage space provided by a bank – not a deposit account. If you want protection for your valuables in a safe deposit box or home safe, there are companies that specialize in that type of insurance, or contact your homeowners’ or renters’ insurance agent to explore policy options. Consider the following examples from across the country before you assume that safe deposit boxes at a bank are the ultimate in low-cost safe storage options:

- Woman fighting bank after valuables vanish from safe deposit box – WBRZ 10, Nov. 2017

- What are my options when items are missing from my safe deposit box? – Daily Breeze, Jan. 2018

- Missing items from my safe deposit box. The bank states it is not at fault. What can I do?- OCC

Safe-deposit boxes disappear at HSBC branch – WPLG 10, Apr. 2018

Safe Boxes May Not Be Safe After All – CBS Sacramento, Jul. 2018

Despite the situations described above, a safe deposit box is a secure option for items that you cannot store in your home and elsewhere, but it does entail counterparty risk. When you first get your safe deposit box, ask the bank if there is a 24/7 phone number you can call to get access when the bank is closed in case of an emergency. What you should or should not store there boils down to what the bank has in the lease you agree to. Never use a safe deposit box to store cash, gold and silver bullion or coins, collectibles, jewelry, spare keys, or firearms. In the 1930s, it became illegal to own gold, and the U.S. Government confiscated it. When you went to your safe deposit box, a bank representative accompanied you to make sure there was no gold in your box. If there was, they confiscated it and paid you the prevailing price for your gold in cash.

If there are no co-lessors with specified access rights to your box, do not store trust documents, an original copy of a will, or anything else that heirs must access without you. Never store any item you might need on short notice or during an emergency, which includes items such as advance medical directives, healthcare proxies, passports, a power of attorney, and revocable living wills. A deceased person’s executor might demand access to the box, but those situations can be precarious. Lastly, always keep an updated inventory of the contents.

Since possession is nine-tenths of the law, an option that eliminates a majority of counterparty risk is a home safe. Instead of trusting the bureaucracy of a bank, you will need a discrete plan of action with a trusted family member or beloved friend on how to access the inventory and safe if you plan a trip outside of the country or become incapacitated, missing, or deceased.

A home safe must be fireproof, flood-safe, and have a bolt-to-the-floor design. It should also be a manual combination lock with a key locking option. Low-cost digital combination locks add a layer of risk because batteries die and extraneous events like an EMP may render them inoperable. The next strategy is where to hide it. Hiring a subcontractor to build a space entails another layer of risk because you give away your secure location. Evaluate your own level of DIY carpentry skills before deciding on an option.

- Within a Wall – behind a mirror or painting are obvious search areas for the seasoned thief, so you will need to be more creative, rather than lazy.

- In the Floor – a large safe can be heavy, but small safes fit neatly between floor joists.

- Concrete Slab – basement foundations are a good bolt-to-the-floor option, and then you can camouflage it.

- Camouflage – camouflage is easy if you use your imagination and put yourself in the shoes of a burglar. The larger the safe, the more difficult it is to hide. For example, an option is a medium-sized safe bolted to a wooden floor in a closet and then covered with an opaque box marked as “winter clothes.”

- Improvise, Adapt, and Overcome.

Stevie Ray Vaughan –Tin Pan Alley (Dirty Pool)

Plan Your Trade, Trade Your Plan

Website: TraderStef.com – @TraderStef on Twitter & Gab

Headline Collage Art by TraderStef