NATO and U.S. tensions with Russia over the potential for a renewed military invasion of Ukraine have elicited a tsunami of media-driven rhetoric from all players on the geopolitical chessboard. If you need an update on the escalation since spring of 2021, you can find it in “The Surge of ‘Little Green Men,’ and Metal is Poised to Strike Part 1” and Part 2’s ongoing Twitter thread.

One possible response to any new incursion is a broad sanction package floated by the Biden administration and allies to punish Russia, then remove its access to the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network. In Aug. 2018, I opined on SWIFT vs. gold in “Banished, Hacked, Robbed, or Chipped with SWIFT is Ending.” Here is an excerpt:

“Nations that grab headlines are those who already have a gold hoard, such as the European Union, and others that were busy accumulating gold over the last decade to de-dollarize… With counterparty risk in mind, several nations are in the process of removing their financial transaction capabilities from the SWIFT system… Where does gold fit into the big picture with tariffs, sanctions, and alternative payment systems? The new ‘Axis of gold’ includes Russia, China, Turkey, Iran, and others who are working to remove themselves from a U.S. dollar hegemony… gold cannot be hacked, deleted, devalued, or frozen even if an enemy knew where you kept it.”

Last week, I asked Jim Rickards for his thoughts about utilizing SWIFT as a sanction weapon against Russia if its recent military buildup and separatist-held Donetsk and Luhansk in the Dombas region invade and occupy additional acreage in Ukraine.

“Russia has already anticipated SWIFT sanctions by moving 20% of their global reserve position to physical gold bullion stored in Russia. This amounts to about to about $140 billion at the market. That said, there will be no SWIFT sanctions in response to any Russian action in Ukraine. The Russians have already said they would regard this as an act of war, and the European partners in SWIFT have no appetite for it. Biden won’t go there and would not be successful if he did.” – Jim Rickards, Jan. 21

He also mentioned the following on Twitter a couple of weeks ago:

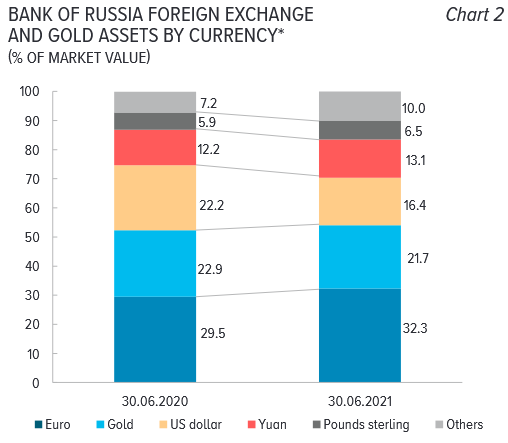

The Bank of Russia’s gold and foreign currency reserves made a historic high this month with a $7.7 billion surge last week, and total holdings clocked in at $638 billion. Its holdings in gold exceeded dollar reserves for the first time in Jan. 2021 and doubled its reserves since 2015, which includes gold, foreign currencies, and special drawing rights. Here are two graphics from the Bank of Russia’s full report:

The following chart is not current, but it illustrates Russia’s commitment to a strategy of increasing its gold reserves since 2006.

Statistics for gold at central banks’ can be found at the World Gold Council (WGC). Visit Incrementum’s “In Gold We Trust” report and chart book for deep analyses on the gold market. Here are the top 15 holders of gold via the WGC as of Jan. 2022.

Wolf Richter recently penned an article about the steady demise of the dollar as a global reserve currency since 1977.

US Dollar’s Status as Dominant “Global Reserve Currency” at 25-Year Low… “Dollar-denominated foreign exchange reserves are Treasury securities, US corporate bonds, US mortgage-backed securities, and other USD-denominated assets that are held by foreign central banks… The plunge of the dollar’s share bottomed out in 1991, after the inflation crackdown in the early 1980s caused inflation to abate. As confidence grew that the Fed would keep inflation more or less under control, the dollar’s share then surged by 25% until 2000 when the euro arrived. Since then, over those 20 years, other central banks have been gradually diversifying away from US dollar holdings.” – Wolf Richter, Dec. 30

The U.S., NATO, European Union (E.U.), and G7 have all promised unprecedented sanctions on Russia if an invasion takes place, but the underlying energy and financial dynamics of the world have shifted since the 1970s when the petrodollar ruled. Russia might not care if relations with the West are ruptured diplomatically and financially, as Russia and Putin’s oligarchs can survive being blocked from SWIFT transactions much longer than Europe can survive without Russian energy. A major break in relations with the West would likely result in a complete embargo of Russian gas and oil via the pipelines to Europe. That’s why Germany and others are asking for a sanction “carve-out.” On Jan. 17, it was reported that the U.S. and European Union were no longer considering unplugging Russia from SWIFT, citing unidentified people familiar with the matter. The report noted that Washington and Brussels were weighing sanctions against Russian banks, and Germany was seeking exceptions to ensure that oil and gas payments remain possible.

Germany Sought Energy Exemption in Russia Finance Sanctions… “The U.S. and its European allies are working to agree on economic retaliation. But Germany is concerned that, without an exemption, the supply of energy to Europe could be jeopardized… Such a sanctions ‘carve-out’ would not prevent potential measures against the Nord Stream 2 pipeline that is due to bring extra Russian gas across the Baltic to Germany in the coming months… as the German government faces criticism from other nations for blocking the sale or shipment of defensive weapons to Ukraine. The Kremlin has repeatedly denied it intends to invade Ukraine, but is demanding security guarantees from NATO. An EU official said that options on the table include restricting Moscow’s ability to convert currency, to trade with the West and access key technologies. The challenge is that as allies work to piece together a weighty suite of measures, each country is trying to shield their own economy from potentially significant side effects.” – Bloomberg, Jan. 25

The other side of the SWIFT vs. pipeline argument is that Russia would lose roughly 45% of its economy’s revenue if it cut energy deliveries to Europe.

Biden Threatens Dollar Ban on Russian Banks… “The U.S. said it could block Russian financial institutions from trading in dollars if Moscow invades Ukraine… Biden also said Europe’s reliance on Russian energy exports could be turned against Moscow in the event of military escalation. ‘Everybody talks about how Russia has control over the energy supply that Europe absorbs. Well, guess what? That money that they earn from that makes about 45% of the economy. I don’t see that as a one-way street. Then go ahead and cut it off — it’s like my mother used to say: You bite your nose off to spite your face.’” – Moscow Times, Jan. 20

The U.S., NATO, and Europe are in a difficult position due to the mismanagement of energy policy for decades, and supply chain constraints from tyrannical policies implemented by governments during the pandemic limit their options. Russia denies it would cut energy supplies in retaliation for sanctions, but plebians with common sense know that all is fair in love and war.

Europe won’t receive Russian oil and gas, if Russia disconnected from SWIFT… “The European countries will not be able to receive gas, oil and metals from Russia in case Russia is disconnected from the SWIFT international payment system, Nikolay Zhuravlev, Vice Speaker of the Federation Council, told TASS on Tuesday… ‘SWIFT is convenient and fast, it not the only way of money transfers.’” – Tass, Jan. 25

Blame Europe for Its Energy Price Crisis, Not Russia… “Europe has been struck by unusually serious energy price hikes, caused not by oil market turbulence, but by misconceived European energy policies. As is often the case, Russia gets the blame. The International Energy Agency’s Fatih Birol and NATO head Jens Stoltenberg have both accused Russia of holding back gas supplies in order to ‘cynically manipulate’ Europe’s energy markets. Oxford Institute for Energy Studies’ (OIES) founder Jonathan Stern, in contrast, blames EU and UK mismanagement for Europe’s energy crisis. Russian gas deliveries to Europe are down by perhaps one-third and inventories of Russian gas in Europe are dwindling, but the fact is also that Russia has kept contractual commitments, albeit no more.” – Energy Intelligence, Jan. 25

Ukraine tensions: How Europe’s eco policies increased reliance on Russian gas – TrendsWide, Jan. 24

The bottom line is that Russia implemented an alternative to SWIFT with China and other nations, but it does not have the same reach as SWIFT. When push comes to shove, the outcome will be determined by who owns the most gold, who can implement alternative commodity trade and financial transactions or wait out the longest, and how willing the participants are to potentially launch World War III.

Nancy Sinatra – These Boots Are Made For Walking

Plan Your Trade, Trade Your Plan

TraderStef on Twitter , Gettr / Website: TraderStef.com

Headline Collage Art by TraderStef