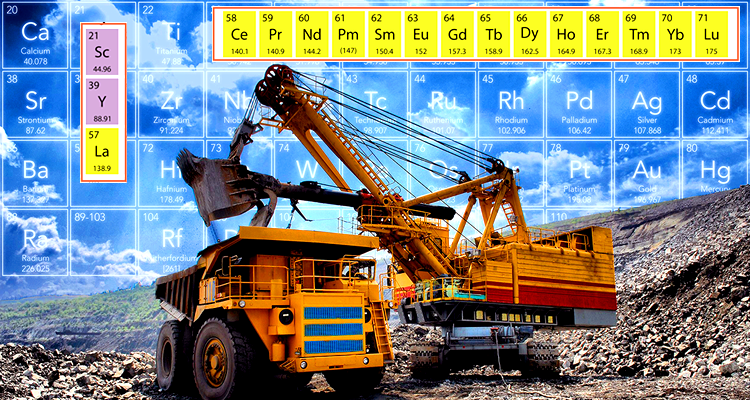

I penned an article on the importance of rare earth elements (REEs) last year when the trade war between China and the U.S. began to heat up. There is some information included in that article about a major REE discovery in North Korea.

Rare Earth Trade War as an Ultimate War Trigger… “There is a category in the tariff-tossing sandbox spared thus far, but it’s a possibility if the trade war becomes extremely nasty. Many underestimate the importance of rare earth elements. Wherever you look in the world, and especially in electronics, REEs permeate the manufacturing of cell phones, televisions, automobiles, computers, monitor displays, superconductors, magnets, alloys, renewable energy, medical devices, caustic cleaning agents, specialized glass, anti-counterfeit embedding, aerospace, lasers, various high-tech military applications, and so many more. You are looking at products that require and contain REEs. There are 17 known REEs found on Earth, and the word “rare” connotes scarcity, but they are abundant all over the world in small amounts.” – TraderStef, Sep. 2018

The reliance on REEs from foreign sources has worried U.S. officials ever since 2010 when China reduced their exports, which caused a spike in prices, threatened an embargo on Japan following a diplomatic row over a fishing vessel, and brought to light the national security risk for U.S. technology industry and military applications.

Did China really ban rare earth metals exports to Japan?… “But did the rare earth metals embargo actually take place? Two recent studies cast doubt on whether there was actually an embargo on exports to Japan and, if there was, whether it was linked to the Chinese trawler captain’s arrest. Analysis of Japanese port data from the Japanese Ministry of Finance shows that there was no uniform drop in Japanese imports of Chinese rare earths following the trawler collision. Similarly, a 2012 article in The Chinese Journal of International Politics cites Japanese and US news media to demonstrate that Japanese officials and businesses had been aware since mid-August 2010 of Chinese plans to reduce their worldwide rare earths exports. The studies suggest that any decline in rare earth exports to Japan in the latter half of 2010 was more likely the result of China’s earlier decision to cut worldwide rare earths exports. Chinese industry newspapers and magazines, such as Xitu Xinxi (Rare Earth Information), suggest that in July 2010, two months before the trawler collision, the Chinese Ministry of Commerce announced its decision to reduce China’s global rare earths exports by 40% in the second half of 2010.” – East Asia Forum, 2013

The supply chain issue escalated in May of this year when China threatened to restrict exports of REEs as leverage in retaliation for sanctions on Huawei, the Chinese telecommunications company. Losing access to 80% of the world’s supply would be crippling to the U.S. military and high-tech economy. The U.S. would also be even more dependent on Chinese finished goods that contain REEs and still be without the capacity to produce domestic supply.

- China hints it will choke off U.S. ‘rare earths’ access. But it’s not that easy – Washington Post, Jun. 10

- Pethokoukis of AEI, and Trachtman at Tufts’ Fletcher School discuss the REE issues – CNBC, May 30

The good news is that during late 2017 and early 2018, President Trump prioritized resource extraction on public lands to achieve “energy dominance” with a black gold rush by slashing regulations that block coal mining and oil and gas drilling. He also signed an executive order calling on federal officials to develop a strategy to reduce U.S. dependence on imported REEs. That order followed a U.S. Geological Survey report that confirmed the U.S. does not produce many of the minerals the economy depends upon. In May of this year, the U.S. wisely chose not to impose tariffs on REEs or other critical minerals imported from China, which helped smooth out a future trade deal and maintain supply chain access until alternatives are developed.

China decided to increase negotiation pressure in August by reducing the resource tax on its companies that mine heavy REEs in an effort to support the sector and maintain its dominance during the ongoing trade war.

- Why Beijing cut the tax rate on rare earths amid the escalating US-China trade war – SCMP, Sep. 12

It turns out that the U.S. can produce its own REEs and provide a large chunk of the global supply. The problem that remains is the ability to refine mined ore into the various elements. In the near-term, the U.S. remains vulnerable to a Chinese embargo, with economic consequences similar to OPEC’s oil embargo back in 1973 and supply disruptions during the Iranian Revolution and Iran-Iraq War.

Going forward, the U.S. does have a few irons in the fire, with plans to secure national security needs with REE self-sufficiency, as was accomplished with a boom in domestic oil and gas production. An offer by the POTUS to purchase Greenland was a brilliant idea due to its rich mineral resources, but the issue of infrastructure to refine ore would still be a roadblock to develop sufficient supplies in the near-term.

One leg of the plan is to build a domestic processing facility. Australia’s Lynas (OTC: LYSCF), the world’s largest rare earth producer outside of China, is finalizing an agreement with Blue Line Corporation in the United States to build a heavy rare earth processing plant in Texas.

- Australia sees opportunity to boost critical minerals supply to U.S. – Reuters, Sep. 30

A second leg of the plan involves an active mining operation in California with a processing infrastructure slated for activation next year. The new owner and operator of the Mountain Pass rare earth mine is MP Materials (MP Mine Operations LLC is a private company). Mountain Pass is the only functioning REE mine in the U.S. and was operated by Molycorp until it filed for bankruptcy in 2015. MP Mine Operations put in a winning bid of $20.5 million and took over the mine in 2017.

California rare earths miner races to refine amid U.S.-China trade row… “The owner of the only U.S. rare earths mine is going on a hiring spree as it looks to significantly boost production, part of a strategy to build out American refining capability after China raised tariffs on the minerals amid an escalating trade war. By next year, MP Materials aims to be the first U.S. company to refine rare earths since 2015 when Molycorp Inc, the former owner of California’s Mountain Pass mine, went bankrupt, executives said. The mine has relied on China for rare earth processing, fueling national security concerns.” – Reuters, Aug. 23

Co-chair of America’s only rare earth mine discusses China’s threat – CNBC, May 2019

Plan Your Trade, Trade Your Plan

TraderStef on Twitter

Website: https://traderstef.wordpress.com