With a sad but true coronavirus pandemic in China that is crossing international boarders, concerns are growing over the weekend that the global economy and stock markets will take a hit next week. Since the legal team representing the POTUS roasted the Democrat impeachment prosecution out of the gate, the U.S. stock market may experience only a shallow correction and choppy days. The reaction in the market is a tough call to make and Gold may rally on the pandemic fear with silver hitching a ride. I will focus on the technical analysis side of the ledger this evening along with one article and two brief and prescient interviews.

Video: Once silver prices rally to $23, what happens to the industry?… “With gold at a $1,600 base price, silver going to $22 would be transformational for the mining industry… You have seen gold move and we think it is real. As gold miners make money and people return to the industry, they will realize silver companies are undervalued.” – Darren Blasutti, CEO of Americas Gold & Silver, Jan. 24

It is rare that an article about a central bank’s gold reserves includes a photo with a silver hoard on display.

Belarus‘ gold reserves at 42.2t in 2019… “The availability of gold reserves supports the confidence of residents and non-residents of Belarus in the National Bank and the government’s ability to meet the financial obligations and to conduct a monetary policy. Precious metals can be sold, exchanged or used in settlements, should such a need arise.” – Belarus National Bank, Jan. 13

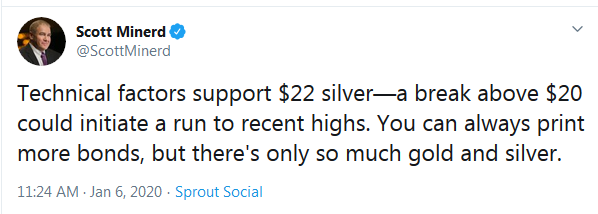

Scott Minerd is the co-founder and Global CIO of Guggenheim Partners with $213 billion in assets under management. He interviewed with Bloomberg at the Davos 2020 World Economic Forum last week and called “the Fed’s bubble-to-bubble monetary policy a Ponzi scheme.” His number one conviction trade in 2020 is silver, as the current price is 65% below its prior peak while gold is fast approaching its previous high, and that signals a “high probability for silver to go exponential.” Wait for it…

Scott’s view on silver fits nicely within the $21.49 Fibonacci level I consistently call the most important price level on the chart before any significant run can take place. The $21.49 price point was important resistance in 2008, is where an exponential run to its 2011 peak found its legs, is the first Dead Cat Bounce resistance level during the 2013 price collapse, and is the resistance area where the price peaked in 2016 following the 2015 low. To view a larger version of any chart, right-click on it and choose your “view image” option.

The seasonality for silver is entering a time of year where it has the highest potential for substantial gains. The closing price in my Dec. 20 analysis was $17.15. Since the Jan. 1, 2020 open at $17.85, silver has gained as much as 5% with an $18.86 high, and as of the Jan. 24 close at $18.08 is resting at 1.5%.

Dynamics within the CFTC’s Commitments of Traders report data on silver has not exhibited any major deviations when layered on top the price action. The small speculators are still confused about the price action, while the large speculators and commercials continue to play the opposite side of the trade against each other as usual.

Excerpt from the Aug. 26 daily chart analysis:

“Odds are high for a pullback and consolidation before a test of $21.49 can take place.”

Excerpt from the Oct. 25 weekly chart analysis:

“There is a confluence of support on the weekly at the $16.50 Fibonacci level, which includes the 21 and 200 EMAs, 300 SMA… an extra emphasis must be placed on due diligence in pattern and candlestick confirmations before risking capital. The long-term outlook remains bullish.”

Excerpt from the Dec. 20 weekly chart analysis:

“Gold and silver have had a mirrored breather within a Falling Wedge and appear to be poised for a break to the upside that will run deep into 2020… There is seasonality precedent for upward pivots during the holiday season… The confluence of the $16.65 Fibonacci, Big W rim line, large buy volume during July and August, and the 200 Exponential Moving Average (EMA) and 300 Simple Moving Average (SMA) provided support at the $16.50 low in early December. The price has pivoted back to the topside trendline of the Falling Wedge and closed back above all the moving averages for the first time since mid-October. The StochRSI peeked its head out into positive territory, and the Momentum indicator has turned upward. The DMI-ADX remains positive but is not set up for the preferred dynamic you want to see for an Alligator Tongue. The Money Flow indicator has not turned upward, and Volumes have no rhyme or reason in relation to price. As usual, big brother gold will determine silver’s near-term timing.”

Silver 4-hour chart showing the Falling Wedge breakout posted on Twitter on Dec. 26, 2019…

Silver weekly chart as of Jan. 24, 2019 close…

The Christmas gift keeps on giving after a decisive breakaway from the Falling Wedge pattern that dominated the chart since Sep. 2019. The confluence of SMAs, EMAs, trendlines, and Fibonacci level noted in previous analyses did their job and provided the support needed at $16.50. One new and important development is the 50/200 EMAs closing in on a bullish Golden Cross pattern. All of the moving averages have lined up below the price action except for the 500 SMA hanging around the $21.49 Fibonacci.

The $18.36 Fibonacci has acted as overhead resistance during the last four weeks and was challenged by a Northern Doji in the second week. Substantial buying came in after each low over the last two weeks and is indicated by the two Hammer candles. After the $18.36 level is breached, the 2016 trendline and $19.58 Fibonacci are the next war. The DMI-ADX remains in a bullish Alligator Tongue trend, the StochRSI is trending upwards, and the Momentum and Money Flow continue on an upward trend but flattened out last week.

The Volume spike during the run up to $18.86 was positive, but the chart really needs substantial buy Volume to appear for the price to reach $21.49 without a choppy struggle. I am bullish long-term and neutral in the near-term until $18.36 and $19.58 are overrun with conviction. Building core positions in paper or physical is ideal while the price point remains low, and there are plenty of opportunities in the near-term to trade momo play sweet spots.

Metallica – Sad But True

Plan Your Trade, Trade Your Plan

TraderStef on Twitter

Website: https://traderstef.wordpress.com