Financial Mayhem

In the aftermath of the deep price plunge this week, cryptocurrencies have somewhat stabilized for the time being as traditional global markets cease trading for the weekend.

The COVID-19 pandemic has triggered some of Europe’s leading economies to go into lockdown. Trump has also issued a fight with Europe as politicians continue to attempt keeping the population calm, with confirmed cases increasing at an exponential rate.

In some countries, the number of new cases continues to double every 3-5 days. By the end of the month, we could be facing a wave of international lockdowns as healthcare around the world begins to buckle. With this fear and uncertainty looming over the heads of many, the already fragile financial markets could plunge lower despite central banks’ futile attempts at keeping the markets afloat.

Bitcoin and Gold Used to Cover Losses; Are They Being Used as a Crisis Reserve Fund?

As I highlighted in the last report, the fundamentals of cryptocurrencies have only strengthened in recent years. This sell-off in contrarian assets (including gold) is likely a result of investors and hedge funds covering their deepening negative balance sheets and not because of anything necessarily wrong with their respective ecosystems.

In an inverted manner of thinking, if Bitcoin and gold’s brutal sell-off is a result of this, it is safe to say that they ARE fulfilling their jobs as crisis assets because many use them as reserves to cover losses!

The topic is open to debate, as many have mixed opinions about gold and Bitcoin’s roles as safe-haven assets in the 21st century. The deciding factor isn’t the short-term, daily market moves, but rather long-term trends.

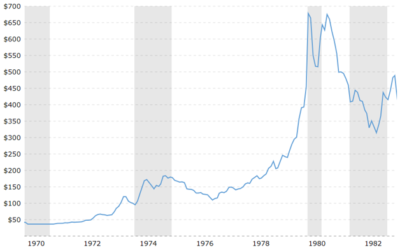

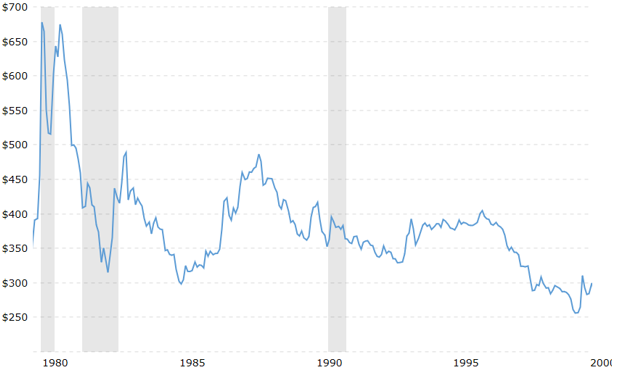

The two images below show gold’s bullish trend after the Nixon shock and Bitcoin hitting its previous all-time high back in late 2013 and early 2014.

BTC above/ Gold below

The final two images below show similarities in a bear market.

BTC above/Gold below

Source: Bitcoin Vs. Gold

Similar trends between Bitcoin and gold have been identified in the past; Bitcoin’s volatility sets the two apart, which is the primary reason why many doubt it to be a safe-haven asset for the time being.

The week ahead for the major indices will be one to watch. Despite cash injections and rate cuts, markets stand on the verge of further steep corrections. The impact on precious metals and digital assets could signal additional sell-offs, but this could be the perfect environment for logical, contrarian investors to flourish from long-term.

This post is for educational purposes. All information used is referenced accordingly. This is not investment advice; please always do thorough research and only invest what you are willing to lose, especially in times of uncertainty.

A Week of Monetary Chaos! Crisis Hedges BTC and GOLD Used To Save WIPED OUT INVESTORS?