If anything, markets are driven by emotions and cycles. Up and down trends to become irrational, at the end of the cycle. Take commodities as an example, the sell off in recent years has become quite irrational. The chart says it all: note the slope of the downtrend, and the fact the commodities index is trading at the lowest level in many decades.

Are we saying that a new uptrend will start in 2016? No, defintely not. But the sell off will stop at some point, and we believe we have reached some sort of long term bottom. Investors should accumulate oversold assets.

It is not only us saying this, but also UBS. The firm says that last year’s rise in volatility was just the beginning of a dramatic rise in cross-asset volatility.” In the group’s macro-view this week, UBS stated that the large cap-driven U.S. indices, as well as Japan and European small and mid-caps, are “the last men standing” at 2015’s close. In 2016 UBS expects these markets to top out also, falling into a full-size bear market which, worst-case-scenario, would last into early 2017. UBS noted with equities predicted to roll over, investors should consider owning gold for better diversification.”

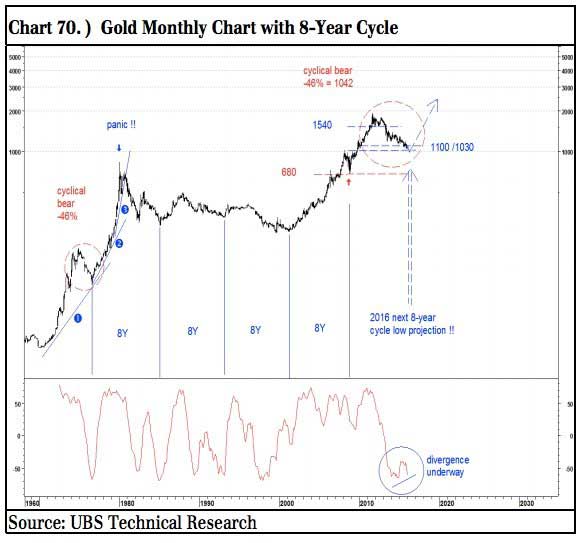

Gold, collapsed in 2013, has been in the process stabilizing last year. Given the cycles in gold, UBS recommends to add gold to a diversified portfolio. Their projection for the price of gold is quite interesting. Based on the 8 year cycle, their view is that gold is about to return to a bull market, as seen on the next chart.

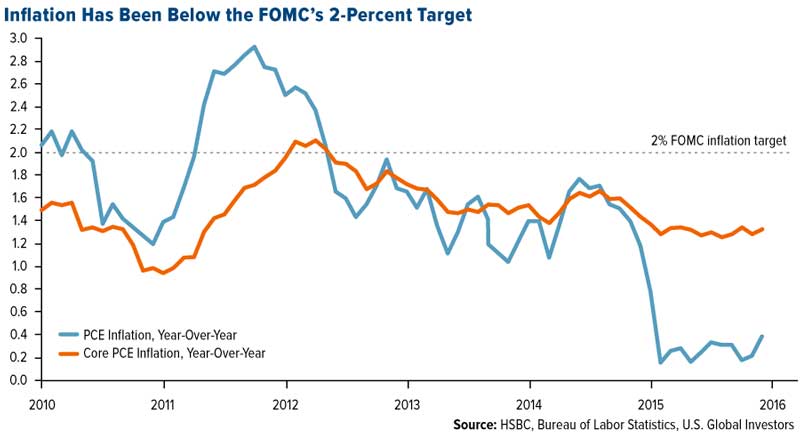

As we know by now, gold is a fear asset, but also an inflation sensitive asset. We also know that the central banks all over the world are doing everything they can to get inflation. And that’s where it becomes interesting. According to HSBC, the median Fed projections show total PCE inflation and core PCE inflation expected to rise to 1.6% by the end of the year. The inflation target of most central banks is 2%. The next chart shows the inflation expectations of the FOMC.

2016 is setting up to become an extremely interesting year. Volatility will rise, that’s almost certainly a fact, and gold could finally be shining again if it continues its path of the past days. Be prepared!