As stocks get more expensive, investors get more bullish. To a certain extent, this isn’t unreasonable. After all, some of the best times to enter a trade are when an asset class is hitting a 12-month high, and the worst times are when it is hitting a 12-month low. This tends to be a strong signal for where the momentum is likely going to trend.

We are currently seeing investors get more bullish at these valuations in the overall stock market, even though prices are at all-time highs. Short positions in the markets are at 3-year lows, after reaching a high in 2016.

Take a look at what investors are doing in the options market, indicating bullish sentiment. Below is a chart of the trending put-call ratio, which could be interpreted as either an extremely bullish sign, based on historical precedent, or as extremely bearish one, if history is any indication of rhyme or reason. Considering the valuation of the S&P 500 and the current business cycle are at polar opposite ends of the spectrum today, investors should start worrying about how much higher stocks can really go. According to the charts, what is clear is that very few investors are concerned about downside risk at this point, which is illogical if they were worried about stocks when the Dow was banging its head at 15,000. Is this what irrational exuberance looks like?

To a certain extent, much of what we are seeing is simply a fading memory of the 2008 crisis, and the further that memory is, the more confident consumers become. Also, Trump came into the picture, promising to roll back regulations, cut taxes, and protect jobs in the U.S., and whether they like Trump or not, investors like what they believe is coming.

The Conference Board’s survey revealed similar results, but what was notable in its report was that the greatest surge in confidence came from the income level of $35-50K, which makes up a large segment of middle class earners. A thriving middle class is a critical component of a strengthening economy that has sustainable growth. In the last 4 months since the election, we have seen confidence especially soar.

U.S. stocks have climbed the greatest wall of worry in history. Many have called it the most hated bull market ever. Rightfully so, as so much of the gain the overall stock market has seen was stimulated with ultra-low interest rates, deficit spending, and debt.

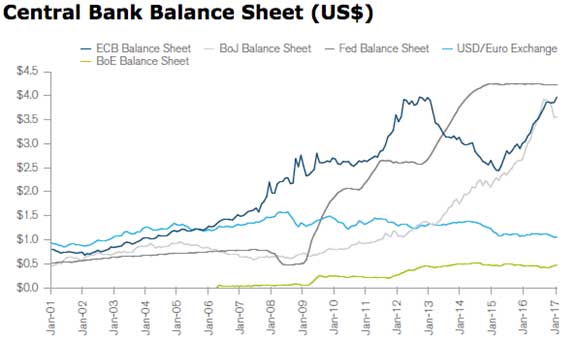

Ultimately, to control these prices, central banks have gotten themselves in a jam. Essentially, they are in this QE-forever position that, if they back off of, will expose the financial bubble’s ugly face.

A $12 trillion global central bank balance sheet is solidified in our financial future – and growing at over $1 trillion a year. This is courtesy of the ECB and the BOJ.

Just like I suggest having multiple streams of income and strengthening your skillsets in the work/business environment, it is equally important to be diversified in the investments you purchase.

At these valuations in the overall U.S. equities market, I would be a little hesitant, to say the least, about getting too excited about much more upside in stocks that are at all-time highs and ridiculous valuations.

If you are like me, it might be hard for you to sell your position, but if anything, I would hold off on ongoing purchases for at least another correction to flush out many of the investors sitting on what could be substantial gains.

Look at other sectors that are depressed in value and accelerate your purchases there. The metals have a lot of upside potential, and especially if we see a reversal in the equities, we are likely to see the two sectors act in an inverse fashion.

Top 2017 trends include precious metals, marijuana, specific base metals, uranium, and Bitcoin.