Top 100 Litecoin Holders Not Selling?

2019 was a positive year for Litecoin. With a successful halving event last August and an impressive price increase in the months prior, well-timed trades would have served investors well.

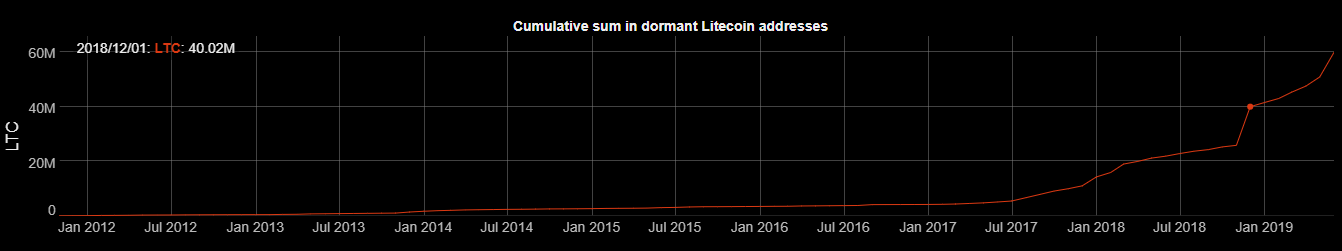

Based on data from statistic Website BitInfoCharts, it seems that some of the largest holders of Litecoin are not selling, but accumulating. The balances of dormant Litecoin holdings are increasing, with a steep increase in purchases occurring from late 2018 onwards.

In the last 12 months, this has increased immensely. While some top holder addresses belong to digital asset exchanges like Coinbase, it highlights that investors have been accumulating Litecoin and that there is long-term confidence in the coin.

Not just Litecoin was being accumulated. Over a year ago, we also covered why record levels of Ethereum were being purchased as the crypto winter of 2018 intensified!

Out of the hard-capped limit of 84 million LTC, there are currently 64,133,625 LTC in circulation, with more than 40 million dormant. At the time of writing, this amounts to over $2 billion worth of unmoved Litecoin.

Top 100 dormant LTC addresses; source: https://bitinfocharts.com/top-100-dormant_1y-litecoin-addresses.html

After Bitcoin plummeted to $3,200, cryptocurrencies reached the bitter lows of the 2018 bear market and rebounded to become the best-performing asset class ON EARTH in 2019. Did the cryptocurrency whales pull the trigger and buy at the bottom of the 2018 downtrend?

Litecoin’s price and hash rate dropped off towards the end of 2019 after its explosive start to the year. Technical analysis theories suggest that its trends are a key indicator of altcoin season or Bitcoin’s next price moves.

This week Litecoin returned to $50 and above, despite the controversy of a lack of technical development within the Litecoin network. 2020 could be another strong year that could potentially benefit from Bitcoin’s own halving event due later in the year.

This post is for educational purposes. All information used is referenced accordingly. This is not investment advice; please always do thorough research and only invest what you are willing to lose, especially in times of uncertainty.