Bitcoin Working as an Anti-Fragile Asset on its Eleventh Birthday!

2020 has kicked off with massive world-changing news: tensions are once again rising between the U.S. and Iran as a drone strike results in the death of Iran’s KEY military figure.

The world is now on a hair-trigger, with oil prices and weapon companies jumping up in value. Interestingly, Bitcoin rebounded from $6,800 to $7,300 and is holding ground at the time of writing.

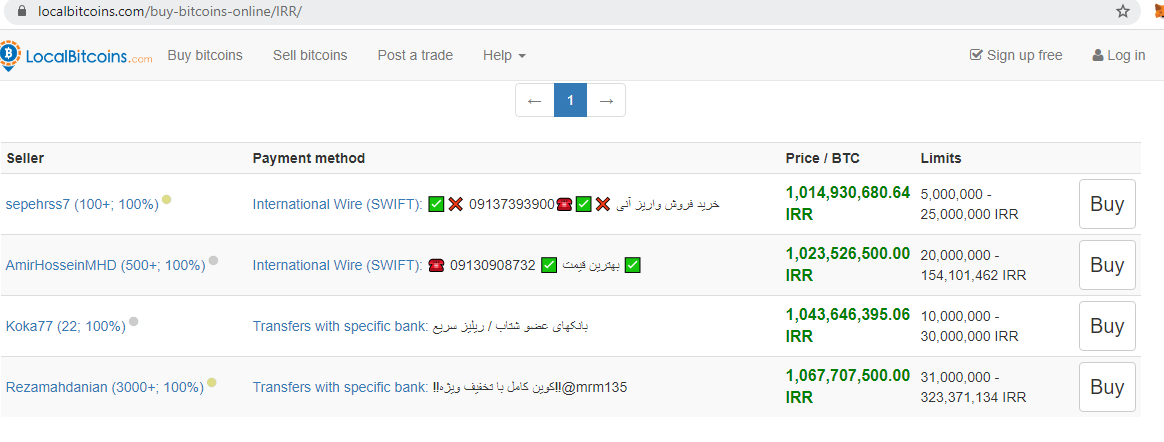

What really turned heads on Bitcoin’s 11th year of existence was on the popular peer-to-peer Website localbitcoins.com, where some accounts were ALLEGEDLY selling Bitcoin at a whooping premium of over 1 million Iranian rials, worth approximately $25,000!

Source: https://localbitcoins.com/buy-bitcoins-online/IRR/

Bitcoin’s official all-time high was recorded just shy of $20,000 in late 2017. It isn’t uncommon for other nations under sanctions, hyperinflation, or other economic and geopolitical woes to offer Bitcoin at a premium, and traders often take advantage of the arbitrage if possible.

Iran, Venezuela, Zimbabwe, and other nations under economic turmoil often have a greater urgency to adopt cryptocurrencies in comparison to more comfortable nations such as the U.S.A., France, the U.K., and others.

Source: To put into perspective (compare with image above), the premium asking prices for Bitcoin in USD terms, https://www.xe.com/currencyconverter/convert/?Amount=1%2C069%2C578%2C000&From=IRR&To=USD

Is Bitcoin Really Being Sold for Over 1 Million Iranian Rials ($25,000)?

Despite the sale offers, the question remains as to whether people are ACTUALLY buying Bitcoin for this price on the streets of Iran. The Iranian government hasn’t shut down the country’s public Internet at the moment, so it’s logical to assume that most Iranians interested in cryptocurrencies are aware of or can access the official prices.

Another valid question on the matter is how much volume is behind the premium price and how liquid it is.

It is also likely that this price is only available for trade via Iranian currency or it could be users of Localbitcoins simply spoofing the Website with grand sale prices. Other Iranians have come forward via Twitter stating that the official price of BTC in Iran is still in line with the rest of the world.

Guy get your facts right ! Btc or dollar prices have not changed in Iran, dollar is being traded @ 13600 toman and btc at 100,000,000 toman = $7300 !!! The 4500 toman per dollar value is a myth which is showing on international exchanges.

— Jason Kambiz (@JasonKambiz) January 4, 2020

(One toman equals ten Iranian rials)

The Good News…

While it’s open for debate as to if Bitcoin reached those highs in Iran and if the sellers were simply trolling the world, if users were genuinely attempting to sell Bitcoin at such a premium (for whatever reason), it’s likely that the geopolitical events unfolding in the Middle East had an impact on the seller’s prices.

As mentioned above, Bitcoin jumped in price internationally in reaction to the escalated tensions. This also bolstered the debated theory of Bitcoin being an anti-fragile asset, similar to how precious metals can be used as an “alarm” in times of economic and geopolitical uncertainty.

As for Bitcoin reaching $20,000 and beyond, time will have to be the judge…

This post is for educational purposes. All information used is referenced accordingly. This is not investment advice; please always do thorough research and only invest what you are willing to lose, especially in times of uncertainty.