Bitcoin Trading Under Attack by U.S. Federal Government

In the recent months, we have heard about Bitcoin regulations and exchanges being investigated, leading to people not being able to withdraw their funds.

Ever since Bitcoin started stabilizing at $1,000 and above, the authorities have kept their eyes on the innovative store of value, but there seems to be more friction, this time directly between users of Bitcoin.

Bitcoin trading has become increasingly popular in the recent years. Combined with high volatility and almost no regulations, Bitcoin and altcoin traders have either lost or made vast amounts of digital currency, relatively unnoticed!

In China, the PBoC issued severe warnings to traders to be cautious, and they have demanded certain flagship exchanges in China to change their anti-money laundering systems to comply with government regulations.

While this hasn’t happened in the U.S. or Western Europe, the government doesn’t take too fondly to Bitcoin trading and Bitcoin-based exchanges…

One example is the IRS demanding the transaction/withdrawal details of users of Coinbase, an American exchange, one of the most trusted in the world for buying Bitcoin.

Usually, banks will only suggest certain exchanges to people or reject a purchase of Bitcoin simply because that person is buying cryptocurrency. This is largely because Bitcoin and many other digital currencies are an effective way to move funds out of a country fast and with very little interference.

Cryptocurrency is totally borderless, and governments worldwide don’t like this!

The prospect of paying taxes on selling Bitcoin for local fiat currency, such as dollars or pound sterling, is becoming a more realistic scenario.

But what are the consequences for traders and exchanges who get caught by the ruthless stance the government can sometimes take on using digital currencies? What do the local authorities see it as…?

Money transmitter laws being used against innovation?

One of the potential consequences Bitcoin traders can experience is being accused of being a “money transmitter without a licence.”

A money transmitter is a business entity that provides money transfer services or payments. Businesses within this field are required to apply for a money transmitting licence to stay within the legal boundaries.

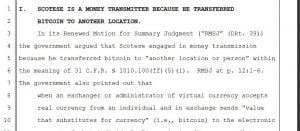

This is what is happening to Dave Scotese. He and his business are being accused of being an unlicensed money transmitter for sending Bitcoin from one address to another and for not obtaining a licence.

Scotese has not broken any laws, and has explained that obtaining a licence would be premature. Until the judge actually confirms the law has been broken, he has stated that he is not a money transmitter because Bitcoin is decentralized and has no central authority controlling it.

Cases like this could prove to be an eye opener for other traders and could help people become aware of the possible future involving governments trying to control how people use Bitcoin or launching investigations into the buyer and seller.

Governments don’t like decentralized or anonymous money.

This isn’t the first time incidents like this have occurred. Users have had transactions from Bitcoin to local fiat stopped several times due to money laundering accusations, and it is becoming a problem for people with large amounts of Bitcoin in the crypto community. People may potentially find it harder to exchange Bitcoin back into fiat.

It is likely that as Bitcoin trading gains more popularity as a savvy alternative to the traditional markets, more attention will be given to problems like this and encourage the laws on digital currency to be more open-minded. Traders may face more requests to submit ID as time goes by, as an attempt by authorities to bottleneck funds leaving their respective countries.

The entire ecosystem of digital currencies and blockchain technology in general is mainly decentralized and borderless, and it makes the redundant banking system totally obsolete.

This is one of the key reasons why governments try to regulate digital currencies, and money laundering is the main topic that is used against Bitcoin as a pretext to enforce new regulations.

Always remember to do your research when starting a Bitcoin-based business or trading Bitcoin and various other cryptocurrencies. As time goes by, more laws will be put in to try and regulate the flow of digital currencies. Please share this article to bring light to situations like this.

Here at Crush The Street we will as the situation progresses!

To read more of Dave Scotese’s post and case details, click here.