Crypto Markets Breathe a Sigh of Relief

It’s been a bitter year for the cryptocurrency markets. With multiple dead cat bounces during the spring and the majority of digital assets being 70–90% down from their all-time highs, people were starting to lose all hope!

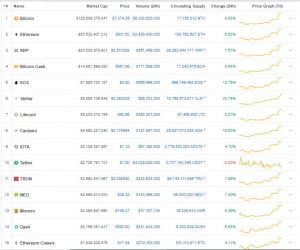

The last 36 hours have been generous. Bitcoin is up 10%, and it’s up slightly more than that weekly (at the time of writing), triggering the rest of the cryptocurrencies to follow and gaining back billions of dollars in capital that were wiped out after the recent sell-off in the past four weeks.

Over the last month, Bitcoin went back to lows of $5,800 that had not been seen since the brutal crash of early 2018, with sideways movement following up until the last two days.

What Caused the Price Breakout?

Numerous reasons could be linked to the price patterns. While Bitcoin has been hovering around a key area of support this month without a strong rebound (until now), there are several positive developments going on in the sector.

SBI Holdings Virtual Exchange – This could be a driving factor in the markets and great news for Ripple (XRP) fans!

The Japanese megabank is one of the leading partners and investors in Ripple, and it has now publicly began accepting new registrations for its exchange, with plans of bringing its huge user base into the digital asset space.

This emerging competitor to Coinbase will be exclusively supporting XRP, Bitcoin, and Bitcoin Cash. In an interview with Business Insider Japan, CEO Yoshitaka Kitao stated:

“It will be number one in the blink of an eye so quickly, so even if a tremendous number of customers come, we can build a system that can bear it.”

BlackRock – The world’s leading asset manager has announced that it will assemble a team to look into cryptocurrencies and blockchain tech. For a company of this size to embrace and potentially use blockchain tech, this would be a huge milestone for the emerging industry.

To put the scale of things into perspective, BlackRock managed $6.3 trillion in assets in June, according to reports.

“We are a big student of blockchain,” CEO Larry Fink stated, but he also added that he does not see high investment demand for cryptocurrencies.

Schnorr – It has been almost a year since the official activation of Segregated Witness for Bitcoin. Fast-forward to the present day and another important protocol update awaits the Bitcoin network, but without the drama!

This is designed to enhance Bitcoin’s scalability and privacy, two things that are high priorities in the evolution of Bitcoin. It would also give users a new way to generate the cryptographic key pair (public and private keys) needed for storing and sending Bitcoin.

Stay Calm and Breathe!

While there are many other influential developments in the space, such as the SegWit update, Litecoin Foundation, TokenPay buying a share of a German bank, and JP Morgan’s positive report, I recommend staying calm and not giving in to FOMO.

We have seen multiple rebounds and the retesting of 2018’s lows this year. While cryptocurrencies and blockchain tech have huge, world–changing potential in price and use cases long-term, we are not out of the bear market yet!

Invest wisely, and do your own research!