The recession’s hard-landing arrival is a slow trainwreck with roots dating back to the spring of 2022 when the United States GDP printed two consecutive quarters of negative growth. Goldilocks’ pundits would have you believe that the economy’s plumbing is more akin to an event rather than a series of financial, political, and economic factors that build and eventually converge with lagging indicators in hindsight. A seasoned investor or trader recognizes patterns that lead to ultimate turning points and practice risk management to hedge a threat and mitigate a “deer in the headlights” moment with a goal to secure existing capital to realize profit opportunities as the population at large sulks over the monetary damage and ignores retirement account statements for months through a financial crisis.

Diver Narrowly Escapes Death as Great White Shark Breaks into Cage – National Geographic

One factor often overlooked by analysts who dig through endless data points published by various sources is the human cost embedded within deteriorating economic conditions. The unaffordability of basic necessities captured attention through high inflation statistics, but most folks would rather ignore the growing homeless epidemic that’s visually appalling. Souls who find themselves homeless are often not due to drugs or mental illness that the majority associate it with but people who exit abusive situations, get divorced, or experience catastrophic financial failure and resort to living in cars, on the streets, and temporarily in public shelter systems that are unsafe.

Homeless in America – The homelessness crisis is getting worse… “Shelters across the U.S. are reporting a surge in people looking for help, with wait lists doubling or tripling in recent months… Some of them live in encampments, which have popped up in parks and other public spaces in major cities from Washington, D.C., to Seattle… And inflation is compounding the problem: Rent has increased at its fastest rate since 1986, putting houses and apartments out of reach for more Americans. The crisis means more people do not know where they will sleep tonight. Living in the streets, people are exposed to more crime, violence, and bad weather… They can lose their job in the chaos, and often struggle to find another one without access to the internet or a mailing address. ‘There’s a certain posture that you take when you are homeless,’ Ivan Perez, who lived in a tent in Los Angeles… ‘You lose your dignity.’” – NYT, Jul. 2022

As homelessness grows, Saratoga Springs can’t arrive at solution… “The day after a March storm covered the city in about a foot of wet snow, a woman was walking along Woodlawn Avenue without shoes and socks. ‘My feet are freezing,’ she said to a companion as she tiptoed into the Salvation Army. She came out with socks, shoes… The parking garage has become a haven for people who are unhoused, where they eat, sleep, and jointly store belongings, mostly blankets and clothes. And while they can find a warm, nightly cot in the city’s Code Blue winter emergency shelter, they prefer the garage because, as one man who frequents the garage said, ‘It’s safe.’ In a city of 28,000 that prides itself on its image — pristine, upscale, and attractive to visitors from around the globe — the homeless presence sullies the optics. And it’s getting worse. The number of people seeking emergency shelter doubled. The nonprofit says 300 unhoused people sought a bed at Code Blue this past winter, with the emergency shelter reaching its nightly capacity of 61… While residents and business owners don’t like seeing homeless people, providers charged with caring for them are stymied. The reason is that the two essential solutions — affordable housing and a 24-7 low-barrier navigation center to connect people with needed services to help them get into housing — are largely unwelcome in the tiny town.” – Times Union, Apr. 14

Meanwhile, a survey last week indicates that 70% of Americans are financially stressed and 58% live paycheck to paycheck, large and liberal crime-ridden cities with felonious bureaucracies misuse or waste taxpayer dollars, some utopian cities have used federal stimulus funds to pay college tuition for illegal immigrants, the Biden administration is funneling over $100 billion to NATO’s fraudulent proxy war in Ukraine for Zelensky’s corrupt regime that embezzled at least $400 million thus far, Pentagon intelligence leaks about the Ukraine war were propagandized as another Russian plot or right-wing narrative before a U.S. Air National Guard patsy was arrested last week, and insane U.S. Green New Deal policies continue to undermine energy independence, national security, industrial production, and exorbitant monetary privileges via a dollar hegemony that’s teetering on its abrupt end. Politicos have major priority issues across the U.S. as we fast approach a multifaceted breaking point, perhaps even secession or a civil war.

The Bureau of Labor Statistics reported this past week that CPI inflation fell nearly a full percentage point to 5% in the year ending in March, which is the lowest since 1Q21 and a far cry from the 9% peak during the summer of 2022. Although, dirt in the details reveals that underlying inflationary pressure remains strong since much of the decline is attributable to energy prices falling 3.5%. Excluding food and energy, “core” inflation edged up to 5.6% due to a significant month-to-month increase in the cost of housing and shelter.

CPI Inflation Report and Chart Courtesy of Bloomberg, Mar. 2023

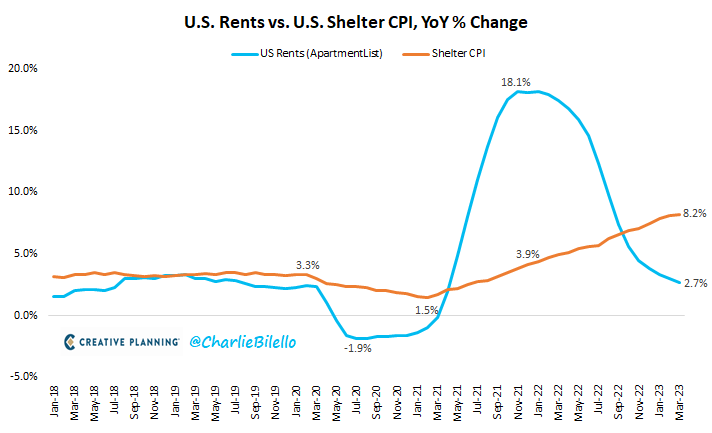

“Shelter CPI moved up to 8.2%, the highest rate of housing inflation since 1982. Why is Shelter CPI still moving higher while actual rent inflation is moving lower? Shelter CPI is a lagging indicator that wildly understated true housing inflation in 2021 and first half of 2022.” – Charlie Bilello, Apr. 12

Unfortunately, crude oil prices rose nearly 8% per barrel in March following Russia, OPEC, and Saudi Arabia giving Biden the middle finger by cutting back oil production by nearly 2 million barrels per day after he repeatedly begged for an increase last summer. The oil rig count in the U.S. stood at 748 this week, which is 327 rigs lower than in early 2019 when Trump occupied the White House.

OPEC+ cuts risk oil supply deficit, threaten economic recovery… “Output cuts announced by OPEC+ producers risk exacerbating an oil supply deficit expected in the second half of the year and could hurt consumers and global economic recovery, the International Energy Agency (IEA) said on Friday…. Consumer countries represented by the IEA have argued that tightening supplies drive up prices and could threaten a recession, while OPEC+ blames Western monetary policy for market volatility and inflation which undercuts the value of its oil.” – Reuters, Apr. 14

The Strategic Petroleum Reserve that Biden dangerously drained by half in order to lower prices at the gas pump will not be refilled anytime soon at a lower price point the administration would prefer. There’s also the “King Dollar Drifting at the Edge of De-Dollarization Road” Part 1 (Twitter thread) and Part 2 (thread) to consider, and I’m sure the unannounced CIA chief’s visit to Saudi Arabia included a request not to use alternative currencies instead of the dollar as settlement for oil because that scenario undermines petrodollar hegemony and the funding of U.S. debt, which will eventually bring higher inflation back to the U.S.

OPEC Cuts Complicate Fed’s Efforts – Peter Schiff, Apr. 9

Fed Shouldn’t Manhandle Economy, Recession – CNBC w/Judy Shelton, Apr. 14

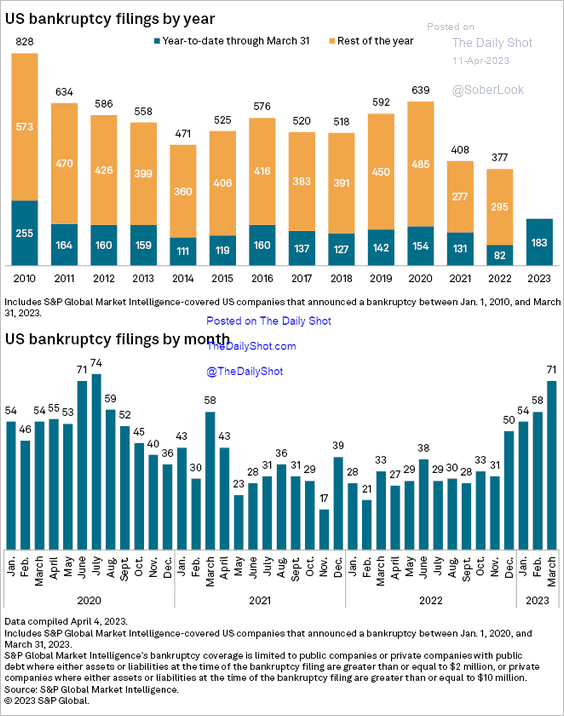

A few more data points to consider before closing shop this weekend are the latest figures on corporate bankruptcies amid a commercial real estate implosion (thread) due to high vacancy rates in office space and a brewing credit crisis, consumer retail spending collapsing, unemployment claims on the rise, a realist commentary from James Kunstler, last week’s Financial Times interview with former Treasury Secretary Hank Paulson who commandeered the Great Financial Crisis bailout I opined about last month in the “Taper Caper Realized Amidst Silicon Valley Bank Implosion” Part 1 (thread) and Part 2 (thread), and Jim Rickards most recent interview on the banking crisis.

You Were Warned: The Implosion of Commercial Office Space Has Begun – TraderStef, May 2022

US corporate bankruptcies increased sharply in 1Q23 – The Daily Shot:

Corporate Defaults to Rise and US Will Enter Recession: Survey… “The vast majority of respondents expecting the country to slip into recession this year… ‘Our members have expected to see the impact of rising interest rates for some time, and we’re beginning to see more credit stress and defaults in corporate borrowers now,’ said Som-lok Leung, executive director of the IACPM. ‘Unfortunately, this could take some time to work its way through the system.’ In addition, 84% believe the United States will enter a recession sometime this year. Commercial real estate could get ‘particularly vulnerable,’ the release stated. ‘Large numbers of office workers continue to work from home, putting pressure on office occupancy rates, while many property owners will eventually have to refinance in a less accommodating banking environment.’ According to respondents, ongoing challenges to the economy include higher interest rates, geopolitical worries, rising inflation, threat to credit availability caused by reduced bank liquidity, and credit risk concerns. ‘Banks, especially regional ones, are not only looking at their deposit bases and whether their depositors will stick around but they’re also hearing from regulators calling for higher levels of liquidity at their institutions,’ Leung said. ‘In response, banks will do what they have to do to preserve capital and one way to do that is to make fewer loans.’” – Epoch Times, Apr. 14

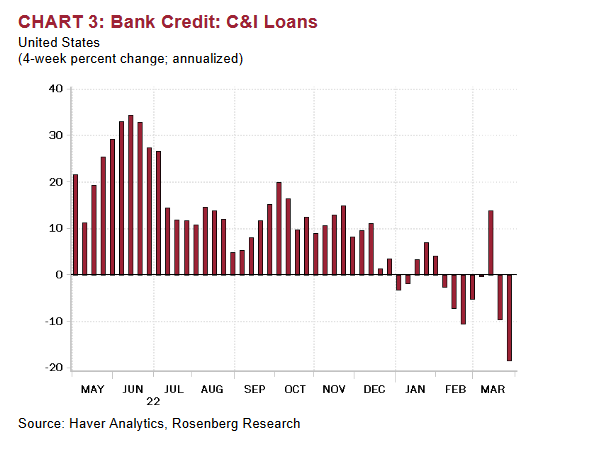

Commercial and industrial loans are plunging. There’s nothing to see here, so move along, it’s just a credit crisis brewing under the hood:

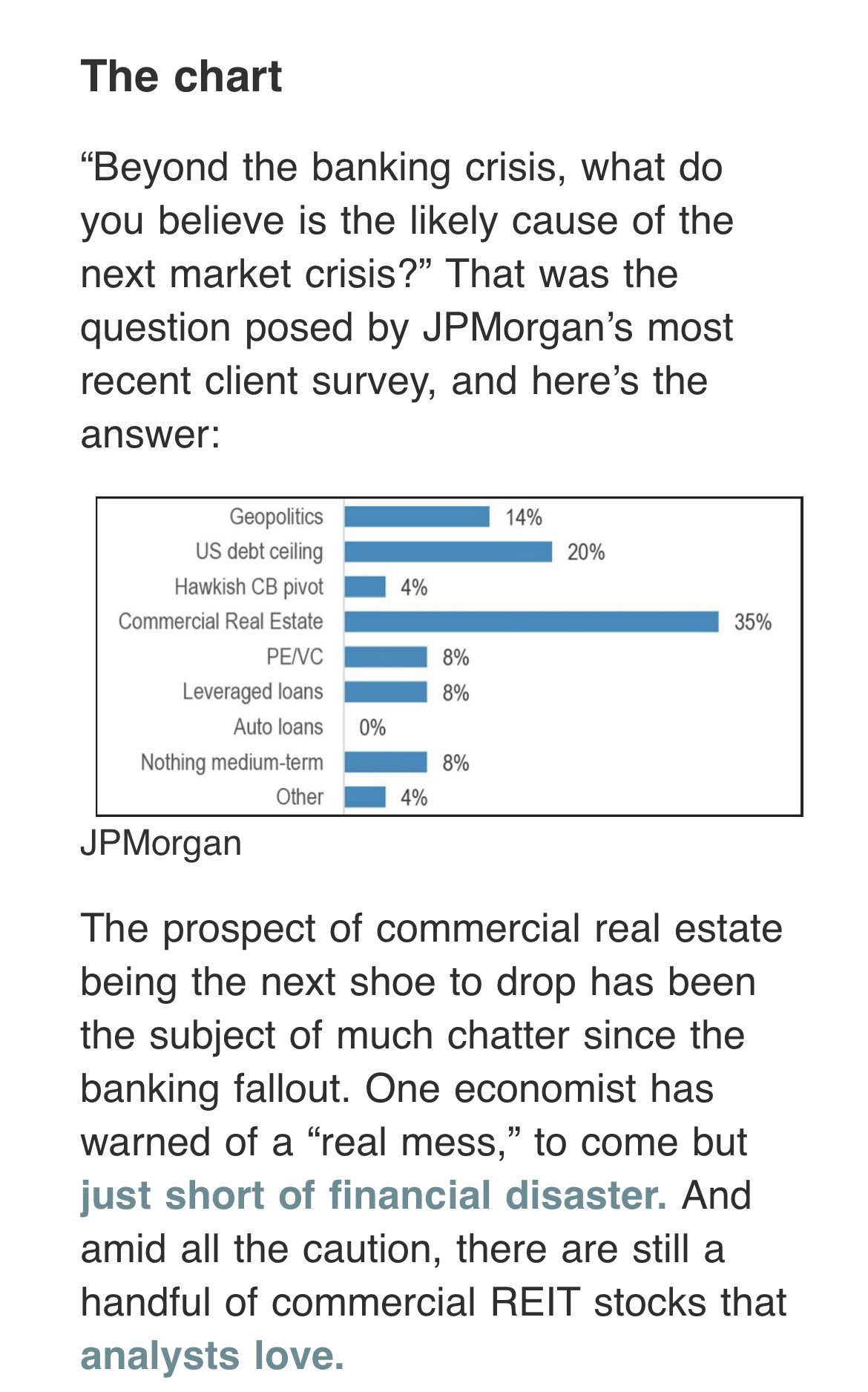

The next shoe to drop amid the banking crisis via JPMorgan and MrTopStep:

The big miss on U.S. retail sales in Mar. 2023 via Trading Economics:

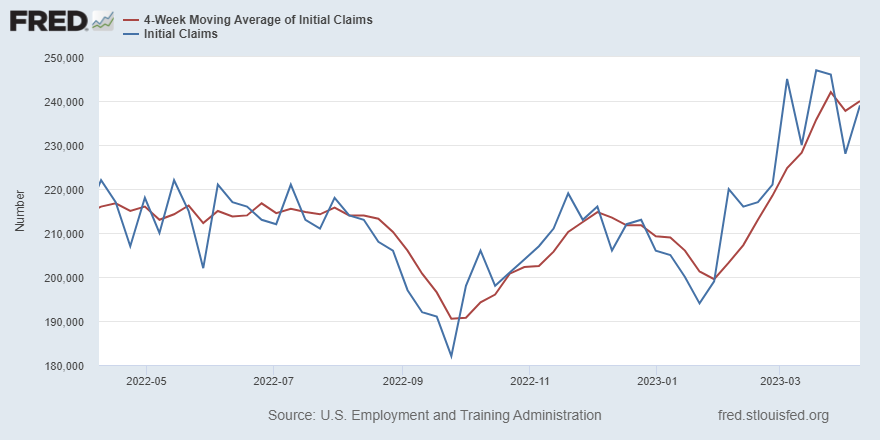

“Initial claims for unemployment insurance benefits increase by 11,000 in the week ended April 8, to 239,000. The four-week moving average also rose, to 240,000.” – St. Louis Fed, Apr. 15

An excerpt from James Kunstler’s latest, “A Nervous Hiatus”:

“The Easter holiday was a strange hiatus in a year that promises fantastic turbulence in public affairs, including especially American politics and our wobbling economy. Financial markets and banks managed to levitate through the first weeks of springtime, but there is a bad odor of imminent failure in the air, at the same time that government’s war against its own citizens shows signs of hardening into the threat of digital currency, renewed efforts at censorship, persecution of political opponents, and a growing awareness of ‘vaccine’ caused death. The natives are restless, the animals are stirring. Events creep toward criticality.”

Lastly, an excerpt from yesterday’s FT interview with Hank Paulson:

Hank Paulson: ‘I think it’s pretty likely we will see a recession’ The former US Treasury secretary on why the banking crisis isn’t over — and why the US-China relationship ‘is on the brink’… “Is the banking panic over, I ask. ‘No,’ says Paulson. Please walk me through why. ‘Some things we know and some things we don’t know,’ Paulson replies. ‘What we know is that if you’re running a small or regional bank right now, you wouldn’t be lending. The capital markets shut down for two or three weeks. Now they’re opening but not to the extent they were. So, I think it’s pretty likely we will see a recession if you look at what’s happening to credit.’ When will that hit, I ask. ‘It will take a while to manifest itself’… Just to be sure I understand you, I say, the crisis will show up in two ways — in recession and in more small bank failures? ‘In the last couple of weeks you’ve had $300bn in deposits move out of the banking system, maybe a trillion since the beginning of the year. These deposits have gone to money markets, and have also moved from regional to big banks. There’s a lot of turmoil.’ So more regional banks will go under as depositors flee? ‘I’ve been around long enough to not predict anything. There is uncertainty and more to come.’”

The Banking Crisis Is Just Getting Started | Part 1 Of 2 – Jim Rickards on London Real, Apr. 12

Plan Your Trade, Trade Your Plan

TraderStef on Twitter, Gettr / Website: TraderStef.com