Since penning Part 1 and 2 (Twitter thread) in early April on the risk of recession this year, the chances of a hard landing vs. the Fed’s sanguine soft-landing narrative morphed into “we have a good chance of a softish landing” when Jay Powell delivered the FOMC’s monetary policy at the May 4th presser.

The Federal Reserve’s ‘Most Anticipated’ Recession In History May Be Coming… “For months, as the Federal Reserve steadily ratcheted up its war against inflation, Fed Chief Jerome Powell insisted that policymakers had everything under control. He stressed that no recession for the U.S. economy was in sight… Yet, suddenly, Powell no longer sounds so reassuring. ‘There could be some pain involved in restoring price stability,’ he said last week at The WSJ Future of Everything conference. He added that the unemployment rate may ‘move up a few ticks.’ Powell’s new message weaves in hopeful talk about plausible ‘pathways’ to a ‘softish’ economic landing. So, it may be possible to miss the big picture: He’s about as close as it gets to a Fed chair whispering ‘fire’ in a crowded theater.” – Investor’s Business Daily, May 27

On Mar. 29, former FRBNY President Bill Dudley opined on Bloomberg that a soft-landing scenario was unlikely and tightening monetary policy in a weak economy is not helpful. During an interview in mid-May, Ben Bernanke criticized the Fed’s slow response to inflation and said it “was a mistake” (aka policy error).

Here are a few excerpts from Part 2 on the growing risk of recession:

“Part 1 covered plunging consumer sentiment, declining consumption, scarcity inflation, and waning GDP. Unfortunately, recession signals are popping up so fast and furious that it’s best to ink them before they outrun my ability to keep articles brief and on point… The government and millennials’ finances are actually bankrupt and struggling to make ends meet… the Federal Reserve issued a warning about a brewing U.S. housing bubble… Pink slips are arriving at mortgage lender employees across the country, including professionals in the processing, underwriting, and closing areas… Home prices are so far ahead of the ability to purchase them… Global recession ‘seems unavoidable’ if Russian sanctions continue… The oil shock is not only triggering a plunge in consumer miles traveled by car that hastens sluggish economic activity across all sectors… Truckers and the transportation industry are getting hit with high fuel costs at the diesel pump and are on the precipice of a freight recession… China’s shipping ports, land freight, and manufacturing hub are severely impacted due to another pandemic lockdown… Foreign countries are taking the lead with social unrest over issues surrounding food inflation and rising fuel costs… The food situation in the U.S. is not looking great as an epidemic of bird flu is raging across the country while the fertilizer shortage and high fuel costs are breathing down the neck of farmers… A persistent drought on the plains and western states are likely to curb this year’s wheat harvest and add to domestic supply worries… The Federation of Bakers has already warned the U.S. government of a looming crisis in the baking industry that’s facing impending cost increases, noting that consumers are likely to experience bread shortages, and overall supply uncertainty not seen in the past generation, ‘if ever.’” – TraderStef, Apr. 5

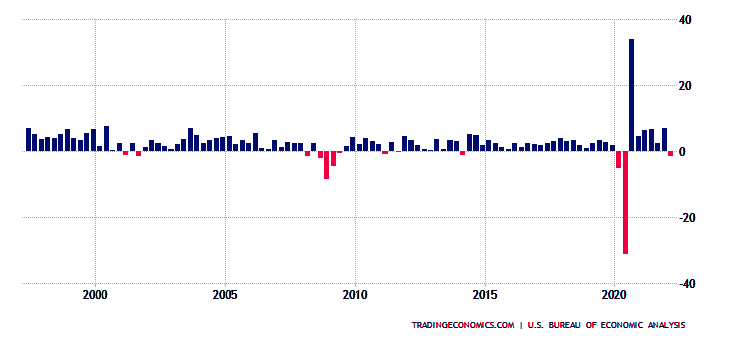

It’s not a coincidence that Powell’s “softish” outlook was born a few days after the BEA’s first reading for 1Q22 GDP clocked in at -1.4% on Apr. 28 vs. expectations of +1.1%. The second reading on May 16 was revised lower to -1.5%, and the final tally is scheduled for release on June 29.

United States Real GDP Growth Rate – Trading Economics

U.S. National Debt ($30 trillion) as Percent of GDP is 125% – St. Louis FRED

1Q22 was the first time that net exports went sharply negative while GDP was falling and the first time that negative net exports caused a drop in GDP.

Chart Courtesy of the Asia Times – May 2022

I published “A Diesel Fuel Shortage Storm on Top of Record High Prices” two weeks ago and noted that a recession in the U.S. was coming sooner than expected. The prices of oil and gasoline products have continued to rise and negatively impact consumer sentiment and spending habits that hasten a recession’s arrival.

I Have A Very Limited Budget’: Americans Forced To Drive Less As Gas Prices Soar… “Prices at the pump are soaring — and Americans are scrambling to change their lifestyles in response. A Yahoo poll released earlier this month showed that 66% of drivers would make ‘significant changes to their driving patterns’ if the national average cost of gasoline lies between $4.12 and $4.35 per gallon — yet the national average cost of regular gas reached a record-high $4.60 per gallon as of Friday… Hornickel is waiting for gas to drop below $4 per gallon before she resumes normal driving activity. ‘I’m a student, so I have a very limited budget,’ she said. ‘My gas expenses just weren’t justifiable anymore.’” – Daily Wire, May 27

Truckers and analysts in the transportation industry are warning that the price of diesel fuel is “way too high” and April’s 8.3% YoY inflation surge is just the beginning of more pain to come. Rep. Byron Donalds was interviewed on Fox Business last week and discussed inflation, famine, shortages, diesel fuel, the lack of oil refining capacity in the U.S., and Biden’s domestic energy policy failure that’s worsening the economic outlook. He also appeared on Sunday Morning Futures today and rightfully argued that Biden’s economic plans are “disastrous” for America and “empower China.”

Biden desperately needs more oil, so why is he canceling leases?… “President Joe Biden has knowingly repeated an untruthful statement about the amount of oil being produced in the United States at this time. Over and over again, Biden has said either that the U.S. is producing record amounts of oil per day or that it is ‘approaching’ record levels of production. Both statements are false. Both are intended to mislead. Both are intentionally deceitful. The truth is that the U.S. was producing significantly more oil in 2019 than it is currently. The most recent production number available, 11.3 million barrels per day in February, was well below the record for the month of February (12.8 million barrels per day in 2020) and far below the monthly record (12.97 million barrels per day in November 2019). In fact, the U.S. is not even projected to return to that record level for the year 2023, according to projections from Biden’s Energy Information Administration.” – Washington Examiner, May 19

World Has Just ‘10 Weeks’ of Wheat Supplies Left in Storage, Analyst Warns… “Sara Menker, the CEO of agriculture analytics firm Gro Intelligence, told the United Nations Security Council on May 19 that the Russia–Ukraine war ‘simply added fuel to a fire that was long burning,’ saying that it is not the primary cause of the wheat shortage. Ukraine and Russia both produce close to about a third of the world’s wheat.” – Epoch Times, May 22

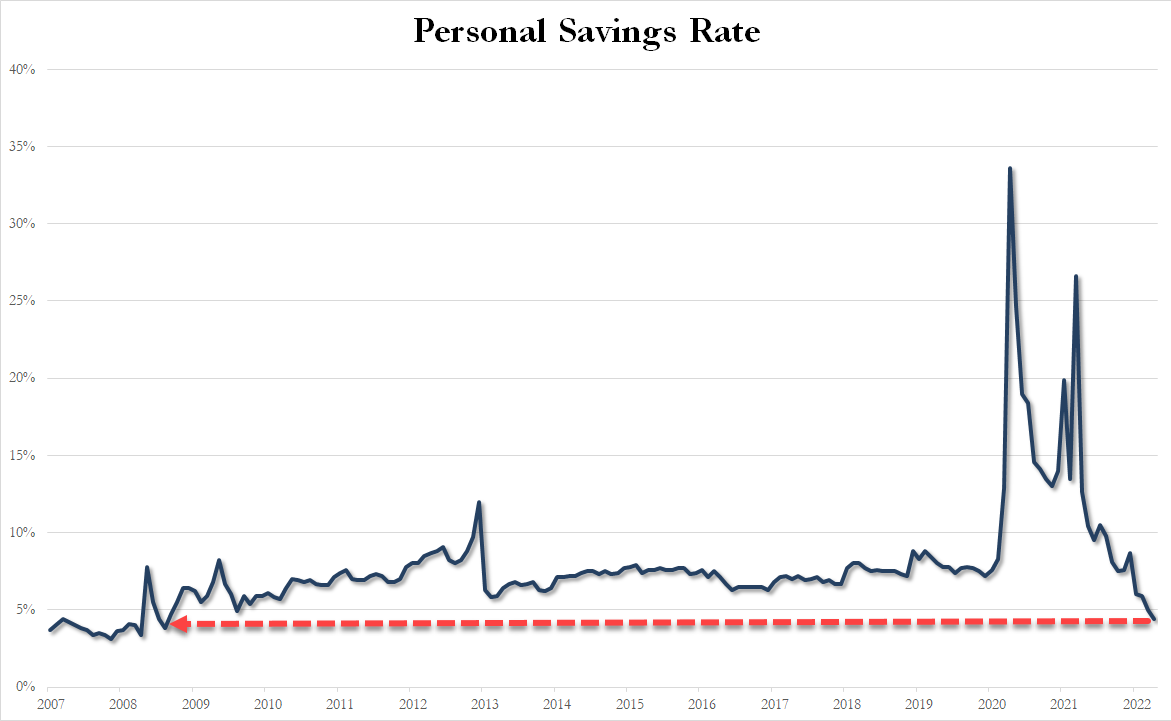

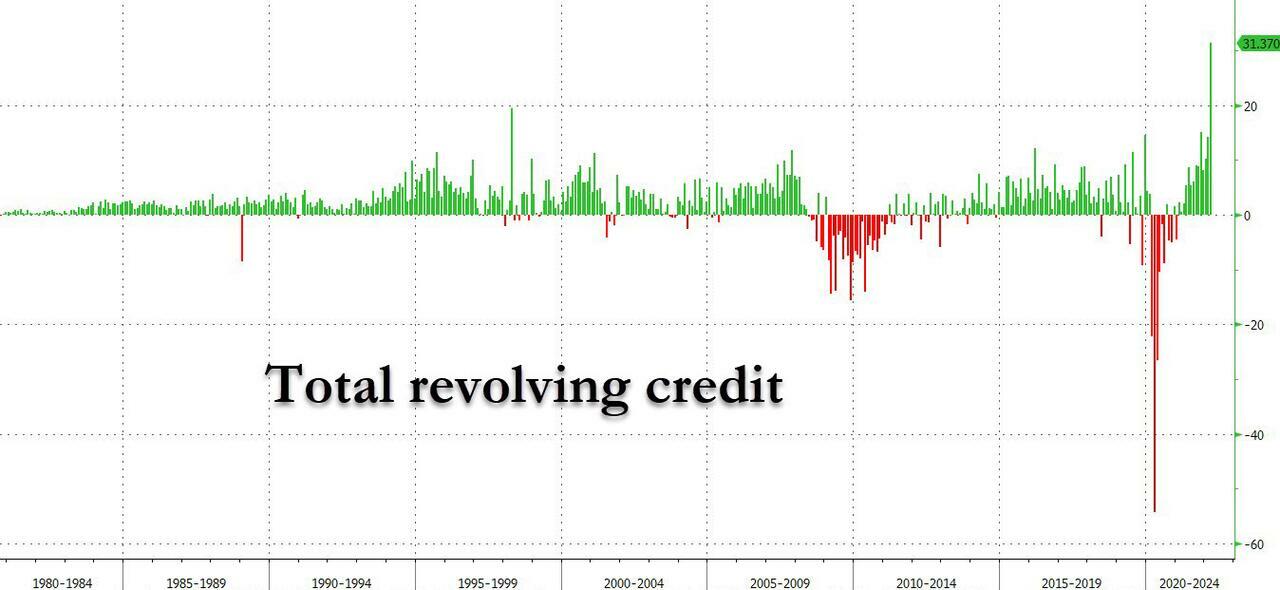

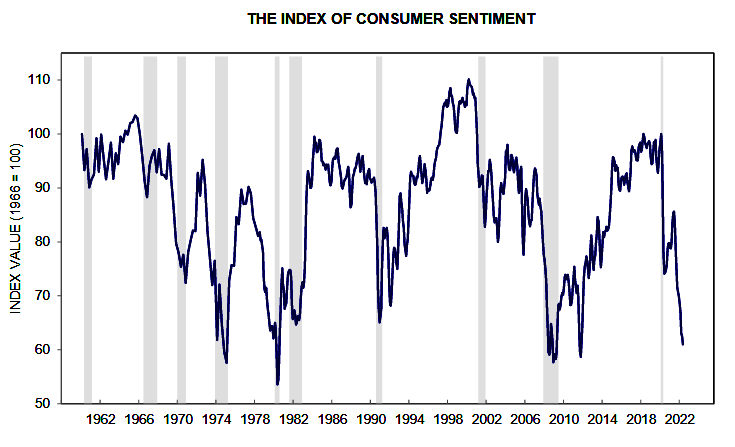

U.S. monthly sales for retail and food services may be at record highs, but inflation across all sectors is skewing pundit analyses. Consumers are responsible for 70% of GDP, recently drained their savings accounts, and are relying on revolving credit card debt to make ends meet. Headline data from the University of Michigan’s Index of Consumer Sentiment fell from 65.2 in April to 58.4 in May. The sub-indices also weakened with current economic conditions falling to a 13-year low of 63.3 and future expectations falling to 55.2. Those are the lowest numbers since the Great Financial Crisis (GFC).

“US ‘strong consumption’ growth came from consuming savings. 0.9% rise in personal spending in April looks good but look at the collapse in saving, with the personal saving rate falling from 8.7% in December to a 14-year low of only 4.4% in April.” – Daniel Lacalle, May 27

Savings Lowest Since Lehman Collapse – Chart Courtesy of ZH

Everyone Maxing Out Credit Cards Before Recession – Chart Courtesy of ZH

On Apr. 20, I published “The Illusion Next Door to Housing Bubble Happiness,” and subsequent data suggests that the housing market is rapidly deteriorating.

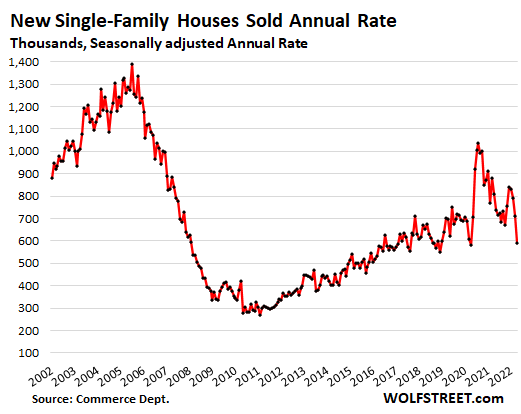

Housing Bubble Getting Ready to Pop: Unsold Inventory of New Houses Spikes by Most Ever, to Highest since 2008, with 9 Months’ Supply, Sales Collapse at Prices below $400k… “Sales of new single-family houses in April plunged by 16.6% from March and by 26.9% from a year ago… Unsold inventory spiked in a historic month-to-month leap of 34,000 houses, and by 127,000 houses from April last year, to 444,000 unsold houses, seasonally adjusted, the highest since May 2008. Both, the month-to-month leap and the year-over-year leap were the largest leaps ever recorded, both in numbers of unsold houses and in percentages… Homebuyers struggle with spiking mortgage rates which make the high home prices that much more difficult to deal with. And with each increase in mortgage rates, and with each increase in home prices, entire layers of potential buyers abandon the market, and sales volume plunges… In the price categories below $400,000, the bottom fell out. The drop in sales year-over-year: $300k to $400k -42%; $200k to $300k -71%; $200k dead… sales above $400k were able to hang in there. And this change in mix pushed up the median price to a new record of $450,600, up by 19.6% from a year ago… Supply of unsold new houses spiked in a historic month-to-month leap from an already high 6.9 months’ supply in March to a dizzying 9.0 months’ supply in April, having nearly doubled from a year ago.” – Wolf Richter, May 24

Is the housing boom about to bust?… “Sellers are slashing prices at levels not seen since before the pandemic amid rapidly cooling market. Hedge fund manager of The Big Short fame warns ‘It’s like watching a plane crash’” – Daily Mail, May 27

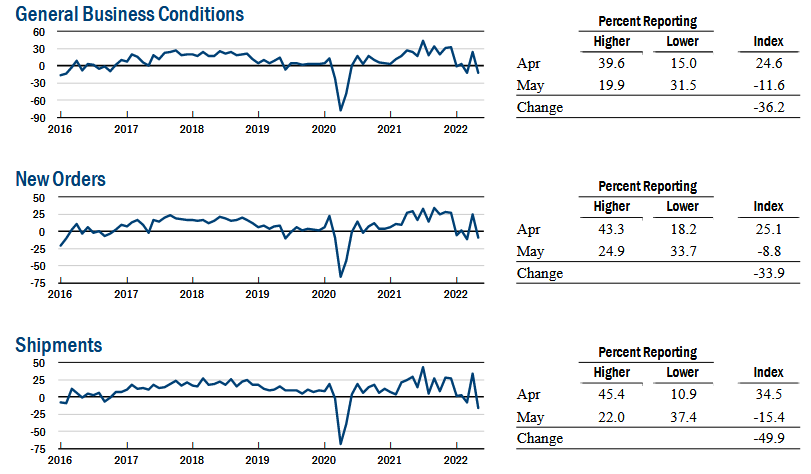

The small business outlook and general business conditions have collapsed far below levels seen during the GFC.

Manufacturing is not looking good, and data points are approaching the GFC level.

The Empire Strikes Out! Empire State Business Conditions Tanks To -11.6 (Is Recession Headed Our Way?)… “The Empire State Manufacturing Survey is out this morning and it’s not good. The General Business Conditions Index fell to -11.6.” – Confounded Interest, May 16

Finally, while the mainstream media parrots a false narrative that Ukraine and Zelensky are winning a righteous war against Russia and Putin is responsible for all the problems in the world, the West ignores the reports it does not want to deal with.

Ukrainian fighters in the east feel abandoned… “Stuck in their trenches, the Ukrainian volunteers lived off a potato per day as Russian forces pounded them with artillery and Grad rockets on a key eastern front line. Outnumbered, untrained and clutching only light weapons, the men prayed for the barrage to end — and for their own tanks to stop targeting the Russians. ‘They [Russians] already know where we are, and when the Ukrainian tank shoots from our side it gives away our position,’ said Serhi Lapko, their company commander, recalling the recent battle. ‘And they start firing back with everything — Grads, mortars. And you just pray to survive.’” – Washington Post, May 26

Ukraine war momentum shifting in Russia’s favor… “An agonizing decision faces Ukrainian President Volodymyr Zelensky and his generals: Order a retreat of forces from key towns in Donbass, or face the risk of their annihilation.” – Asia Times, May 27

“The left wing is so predictable. They launch a false narrative. When it explodes they launch a new one. ‘Ukraine is winning’ is now obviously false. The new false narrative is Russia’s to blame for food shortages. Actually, they’re caused by U.S. sanctions.” – Jim Rickards, May 29

The prospect of a global recession is growing as countries and businesses must adjust to a world where globalization will not survive in its current form.

Stocks Slammed, Inflation, 2Q22 Recession Fears – DiMartino Booth, May 21

The Four Converging Forces That Will Destroy the Economy – Ed Dowd, May 21

Wharton’s Jeremy Siegel: Overly concerned about a Fed overreaction – CNBC, May 24

Plan Your Trade, Trade Your Plan

TraderStef on Twitter, Gettr / Website: TraderStef.com