After an impressive performance in 2016, precious metals investors were eagerly anticipating further momentum this year. Unfortunately, gold markets haven’t lived up to expectations. Although the yellow metal is up nearly 7% year-to-date, it has also lost more than 5% of value since the close of June 6.

The bearishness hasn’t stopped gold adherents in putting up a fight. In what could have been an ugly week for the monetary precious metals, gold closed off with a strong session on Friday, as did its cousin silver. Granted, that’s not changing mainstream minds — gold is still below its 200 day moving average, while silver is trading inside an ugly bear channel.

But before investors consider giving up on bullion markets, we need to recognize the unusual confluence of high-level events. Both the equity and gold markets are experiencing near-record low volatility simultaneously. Even more bizarre, Federal Reserve chair Janet Yellen boosted retail investors with her strong affirmation of the underlying economy.

We should be experiencing an economic renaissance, and a downpour in gold and bullion markets! What’s going on?

Major clues are provided by analyzing international gold reserves. By assessing which countries are acquiring gold, and which are not, it tells us the mentality behind world government bullion procurement patterns.

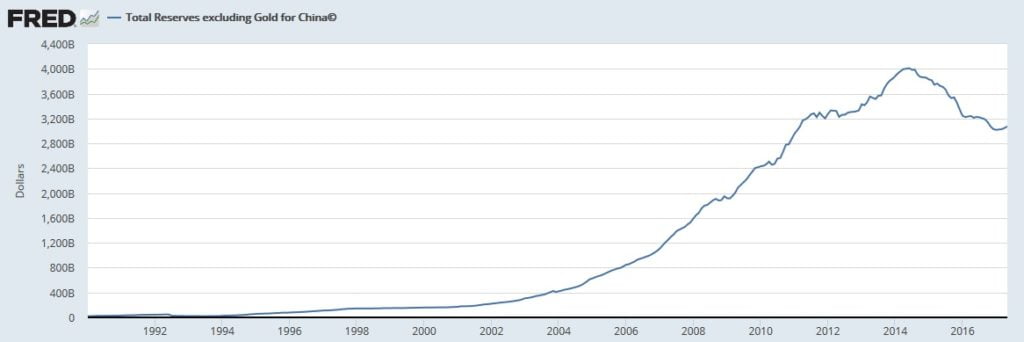

For instance, the Federal Reserve Economic Data provides us the chart of global gold reserves excluding China. Interestingly, we see what appears to be a declining head-and-shoulders pattern. This formation signals that China has been buying gold at a clip rate, while other nations are lagging in their gold reserves.

The biggest clue, however, comes from gold reserves minus the U.K. This chart exploded upwards by a margin of more than 149% since January 2010. The sharp magnitude immediately indicates that Britain is hardly buying any bullion for its gold reserves.

I can understand that to the mainstream, gold is a “barbaric relic,” but do they really think that? Perhaps, the gold and silver price deflation is nothing more than a ploy to increase gold reserves at tremendously discounted rates. This would hardly be surprising since the British government has opened its borders to radical terrorism as a ploy for its citizenry to accept, and even demand, a police state.

Coincidentally, London was the top gold-trading platform in 2015, beating out New York City by a 10% performance-margin. Furthermore, the biggest banks in the world are currently competing for control of the London gold market, which leverages $5 trillion in assets.

It’s not completely out of the question, then, to ask the real motive behind recent unusual trading in the precious metals sector. Perhaps the banks that are supposed to hold the most gold to justify their vast trading networks are running a little low on inventory.