Ammonia-based fertilizers are made from nitrogen and natural gas or methane (CH4) and account for nearly 70% of all manufactured fertilizers on the planet. It is used to support major agricultural crops such as coffee, corn, rice, wheat, miscellaneous forage, and home gardeners to produce higher yields. Roughly 80% of the cost to manufacture ammonia fertilizers is derived from natural gas with its recent price surge of up to 500% and impact on world fertilizer production. In addition, the demand for fertilizer components such as nitrogen, phosphorus, and potash are in a rising trend since at least 2011. Any shortage in fertilizers will eventually slash global crop yields. When other variables on the world stage are considered, the potential for deeper food shortages in the future snowballs.

The pandemic (anthology) fallout has amplified issues for fertilizer production and delivery and the “Supply Chain Crisis Will Not End Anytime Soon” (Part 1, 2, 3). In “War Drums as Prices Skyrocket for Used Tractors and Farmland,” published in Nov. 2021, numerous data points are noted on the looming fertilizer issue, and reports that appeared later in the mainstream media were cited.

Eventually, the supply chain crisis combined with rising inflation weighs heavily on manufacturers, shipping, farmers, and consumers. On an earnings conference call with analysts back in Oct. 2021, the CEO of Archer-Daniels-Midland was being factual but dismissive of U.S. food insecurity and plebian wallets when he stated:

“I would say at this point in time, it continues to be available for farmers only at higher price” – Juan Luciano

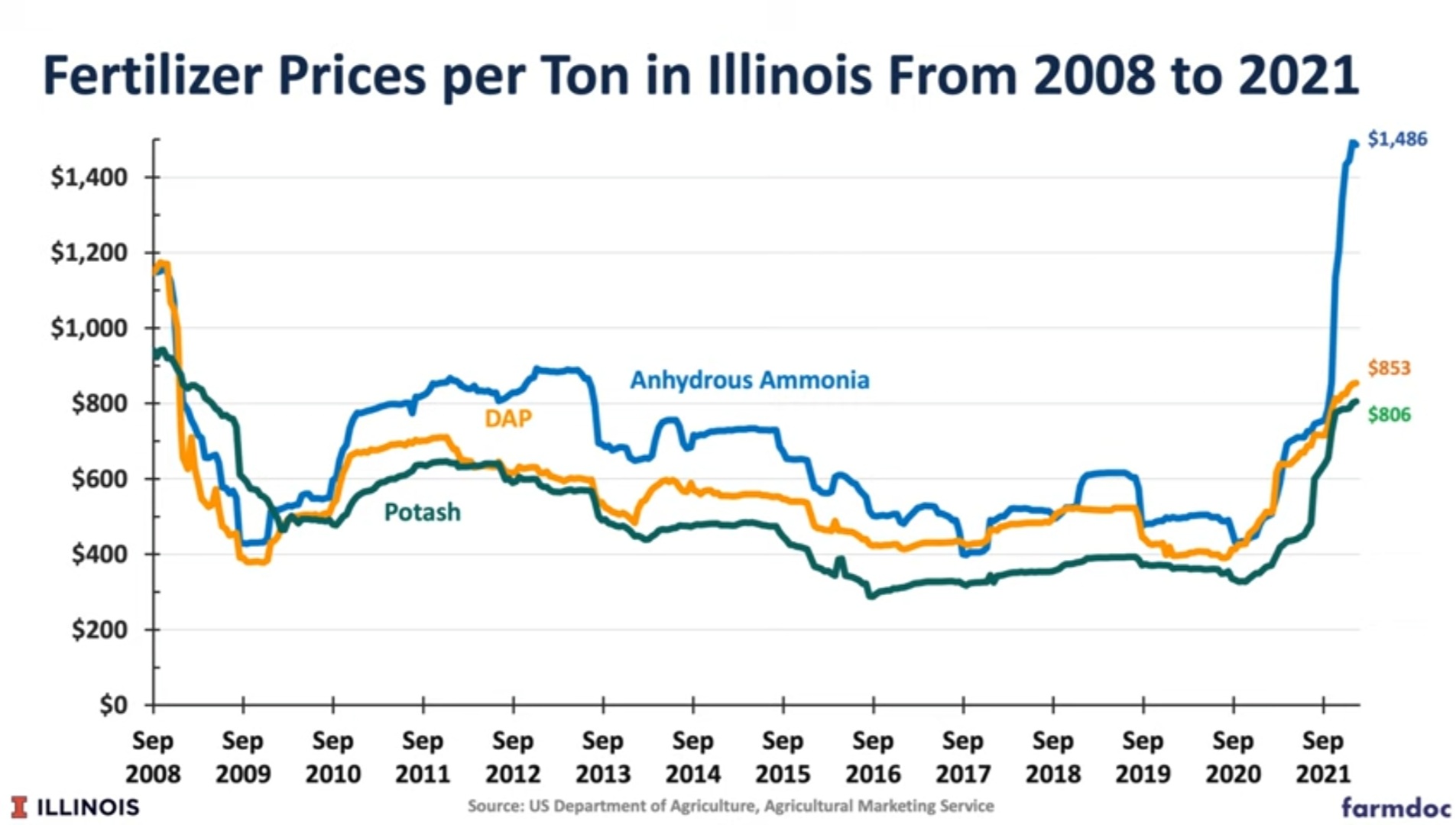

The following chart drives home the reality of soaring fertilizer prices and the potential for future impacts on food inflation from dirt to the table:

“There’s no way around it: fertilizer costs are going to be a major issue in 2022.” – Agriculture.com

Fertilizer Prices Forecasted to Continue Increase: What to Know… “The study conducted by Schnitkey et al., (2021), revealed that fertilizer prices were $746 per ton for anhydrous ammonia, $717 per ton for Diammonium Phosphate (DAP), and $600 per ton for potash on July 29, 2021, which were considerably higher values than in 2020 at the same time. In the breadth of a year, anhydrous ammonia increased by 53%, $487 per ton in 2020 to $746 per ton in 2021; DAP increased by 83%, $390 per ton in 2020 to $717 per ton in 2021, which is its highest price since 2008; and potash increased by 71%, $350 per ton in 2020 to $600 per ton in 2021. Prices are likely to stay high, given the strong demand for and cost of energy resources… According to Ag Valley Co-Op, headquartered in Edison, Nebr., Urea-Ammonium Nitrate (UAN) fertilizer prices quoted to area producers at this time last year have now seen close to a 200% value increase compared to current 2021 levels. Based on historical context around the highest-recorded prices, producers will want to be aware of elevating consumer demand for energy and consequential nitrogen fertilizer pricing impacts in 2022.” – University of Nebraska–Lincoln, Oct. 2021

Veteran war correspondent Michael Yon has been ahead of the curve with his reportage on the unfolding geopolitical and socioeconomic crisis since Jan. 2020. Sometimes he only said to “buy food.” Stocking your pantry while prices are lower and essentials haven’t totally disappeared from your local grocery store is prudent. Non-perishables can always be consumed later if not needed and properly stored.

Let’s add fuel to the fire of Michael Yon’s worldview with the following thoughts from Luke Gromen:

“In a world war no nation will be paying their debt. War is all about supply chains. The ‘US produces USDs and the world produces stuff” model would be exposed. Consider what happened to US supply chains and inflation in COVID – USD would quickly hyperinflate vs. stuff in a big war. At the beginning of WW2, the US would not accept then-global reserve currency GBP from the UK as payment – only USDs or gold. The Arabs were reportedly only taking gold for their oil, not USDs from the US late in WW2. China would not be taking USDs in a big war, nor would Russia.” – Jan. 31

Do not make pantry decisions solely on what’s happening at your local grocery store, and don’t dismiss the potential consequences of geopolitical short-fuses playing out with Russia vs. Ukraine and China vs. Taiwan.

More Fertilizer Volatility?… “Russia, Ukraine Conflict Could Cause Fertilizer Supply, Price Issues. We do know a conflict in the Black Sea region would probably lower the prospects of less-expensive fertilizer prices for U.S. farmers in 2022 … This comes on the heels of the well-documented supply challenges of 2021. Record-high fertilizer prices, trade disputes resulting in tariffs, supply disruptions because of various reasons and higher manufacturing costs for fertilizer producers all came together to push nutrient prices significantly higher in 2021. The hope for relatively calm waters in the fertilizer industry in 2022 may be fading… If Russia invades Ukraine, most likely it would incur a whole host of sanctions from other countries. These measures could affect many industries… Canada, which is also a large potash producer, would have to supply more into the world market if Belarus and possible Russian potash producers are hampered due to sanctions.” – Progressive Farmer, Jan. 27

We currently have a truckers’ strike and “Freedom Convoy” protest in progress in Canada over pandemic-related vaccine mandates and other dictatorial decrees. The convoy strategy to shut down national capitals is spreading around the world. It will further impact grocery stores that already have empty shelves, and future shipments of fertilizer, food, and consumer goods will not escape pandemic tyranny at border crossings.

Just When You Think Fertilizer Shortages are Improving, Trucker Vaccine Mandates Slam Supply Chain Into Disarray… “Fertilizer availability concerns have plagued agriculture for months, but recent COVID-19 vaccine mandates in both the U.S. and Canada could take even more truckers off the road. As the supply chain is already wading through chaos and shortages of everything from food products to equipment parts, more fertilizer shortages could be coming just before spring… The Canadian Trucking Alliance estimates the mandate may block up to 20% of the 160,000 Canadian and American cross-border truckers from entering either Canada or the U.S… And in the U.S., effects of driver shortages are just starting… ‘About 50% of Canada’s fertilizer is exported into the United States. So, if an unvaccinated driver is not allowed to go into Canada to pull that fertilizer out, we’re going to have some issues there. And then vice versa, even if the Canadian driver that’s going to pull some fertilizer down into the U.S. isn’t vaccinated, they’re not going to be allowed in.’” – AgWeb, Jan. 27

I’ll wrap up tonight with a few words from a “farming insider” that was quoted on Michael Snyder’s Website on Jan. 23. If you have a modest garden as I do, I suggest you make it a point to purchase fertilizer and/or your preferred soil amendments asap and store them for spring.

“Things for 2022 are interesting (and scary). Input costs for things like fertilizer, liquid nitrogen and seeds are like triple and quadruple the old prices. It will not be profitable to plant this year. Let me repeat, the economics will NOT work. Our plan, is to drop about 700 acres of corn off and convert to soybeans (they use less fertilizer, and we also have chicken manure from that operation). Guess what? We are not the only ones with those plans. Already there is a shortage of soybean seeds, so we will see how that will work out. The way I see it, there will be a major grain shortage later in the year, especially with corn. I mean, we are small with that. What about these people in the Midwest who have like 10,000 acres of corn? This will not be good.”

Just When You Think Fertilizer Shortages Are Improving (Video) – AgWeb

Plan Your Trade, Trade Your Plan

TraderStef on Twitter, Gettr / Website: TraderStef.com