By all mainstream accounts, the numbers produced by the U.S. Department of Labor‘s jobs report for the month of February was impressive — highly impressive. Prior to the release, economists surveyed by Dow Jones were forecasting a 200,000 jobs increase, keeping in line with prior trends. However, the actual data did more than just steady the boat. With a surge of 242,000 jobs added to the economy, Obamanomics beat consensus by 21% — a landslide victory by any other name.

Except that this isn’t just any old scrimmage. The jobs report is one of the most critically examined documents by Wall Street, and for good reason. Whether the news is favorable or not, it provides a near real-time insight into overall economic health. It also helps to gauge whether monetary policy and other measures are having the desired impact.

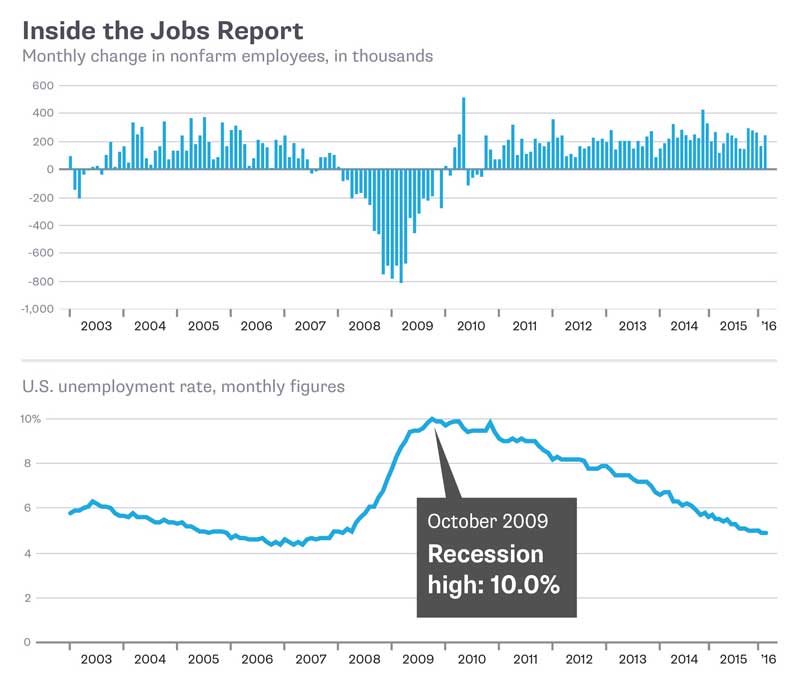

So what to make of the most recent jobs report? If we were to look at pure numbers, you really couldn’t ask for anything more. The employment opportunities created maintains crucial momentum, especially in a presidential election year. Better yet, the unemployment rate remains at a multi-year record low of 4.9%. On the face of it, this bodes well for companies like job recruiters and staffing agencies, as more people will theoretically be encouraged by the bullish data.

Chart from Bloomberg — http://www.bloombergview.com/quicktake/monthly-us-jobs-report

But before we start breaking out the champagne, let’s look at the context. While most job categories did grow nominally, the biggest criticism is balance — or lack thereof. Following education and health services, the sector that saw the most improvement was retail trade. Next was leisure and hospitality, and then professional and business services. It should be noted that the latter contains jobs that are defined by the Bureau of Labor Statistics as “temporary help services.”

Among the job laggards, the mining and logging industry saw the steepest declines — no surprise there, given the poor state of affairs in the energy and commodity markets. However, the losses in manufacturing jobs were not that far off, conflicting with economic data released earlier this week that suggested optimism in the sector. Rounding off the underperformers was transportation and warehousing.

Here’s the main takeaway. It’s not just about jobs that don’t pay a lot of money. The vast majority of employment growth comes from cyclical or seasonality-driven industries. It is a well-known fact, for example, that several retailers don’t make a profit until the fourth quarter, when Black Friday and the holiday shopping season rolls around. This also explains the loss of jobs in transportation and warehousing — why keep around specialized blue-collar workers who command a relatively high salary when it’s off-season for many retail partners?

Ultimately, this lack of balance in the recent jobs report makes it a “so what?” disclosure. Yes, the economy is growing on paper, but it doesn’t necessarily mean that individual circumstances have improved.