When Bloomberg ran their gold and silver manipulation headline last week — which involved the U.S. Department of Justice probing improprieties within bullion markets, as well as within U.S. Treasuries and specific crude oil markets — the internet was abuzz with passionate rhetoric. After years of being sidelined as conspiracy theorists, the core battle cry of gold manipulation was finally being taken seriously by mainstream business news. But the moral victory may have some near-term consequences that will need to be worked out in the markets.

The most obvious concern is trading volume. While established bullion investors have all the evidence in the world to be convinced that their asset of choice is the “right” one, it will be difficult to convince people new to the hard asset sector. Worse yet, the layman has every reason to be worried: no one wants to invest in a market where the outcome is rigged, typically to the detriment of the outsider. And while bullion investors may not care what others think, the reality is that in order for the markets to move, enough people must invest in it.

But there may be a silver lining — no pun intended! Since the fundamentals of holding hard assets within an investment portfolio is still valid — especially in the current macroeconomic climate — we could see a push into the mining sector. Generally, reputable mid-tier to top-tier commodity producers will track the performance of the underlying market, but they are also regular companies with regular corporate issues. Therefore, regardless of what occurs in the metals market, other factors affect the pricing of the mining company’s shares.

These contributing elements may also hedge against volatility within the commodities market. For example, smart mining companies have already accounted for the brutal bear market cycle in the precious metals; therefore, they’ve made the adjustment in their business plan to remain a viable entity and any further volatility is unlikely to have the same pernicious effect like it did when the bears first struck.

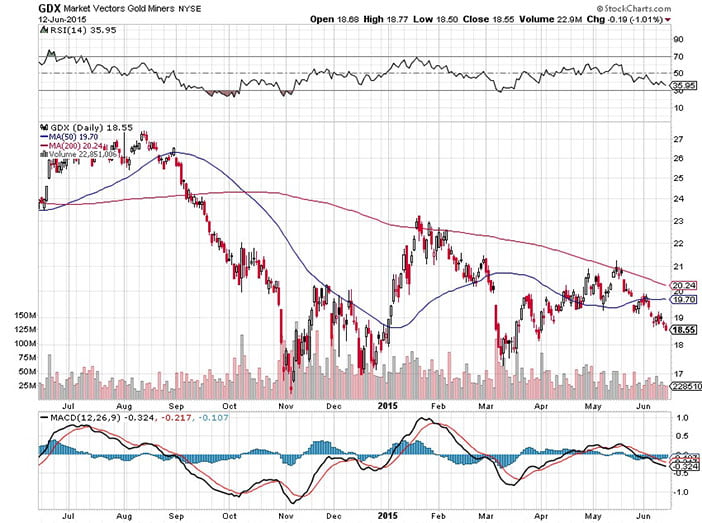

The evidence of this adjustment can be seen in the technical charts of Market Vectors Gold Miners ETF (GDX), especially when compared to that of the gold and silver funds, SPDR Gold Shares (GLD) and iShares Silver Trust (SLV). When the bullion markets touched bottom in November of 2014, the GDX from that time continued to march upward in a series of higher lows. But both the GLD and SLV in March of this year retested the same level of the November bottom. Their charts feature a horizontal slant whereas GDX is definitely inclined.

This is not to say that the miners are a better investment than the underlying assets; certainly, more than one factor must be accounted for in order to make such a statement. Nevertheless, it does demonstrate that mining companies have more tools on hand to deal with market swings — and that may ultimately attract the investment dollars.