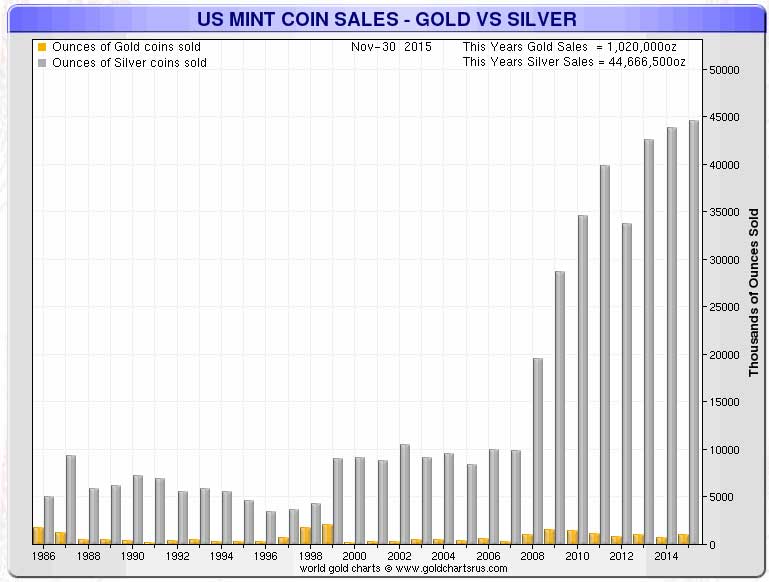

Demand for silver coins is truly exploding, especially in the last couple of months. Let’s look at demand in two of the most important mints worldwide. The U.S. Mint is certainly the bellwether for coin demand, as it’s among the largest mints worldwide.

As the first chart shows, silver coin demand on an annual basis has set another record in 2015. The chart shows that 45 million of ounces of silver coins were sold in the first 11 months of 2015. So the full year data will be even higher than the 45 million which we see on the chart.

The above chart clearly shows that silver demand started to truly explode as of 2008 / 2009. The second chart puts silver demand in perspective, by comparing gold coin demand with silver coin demand since 1986, the same time period as the previous chart. Interestingly, gold did not explode after 2008.

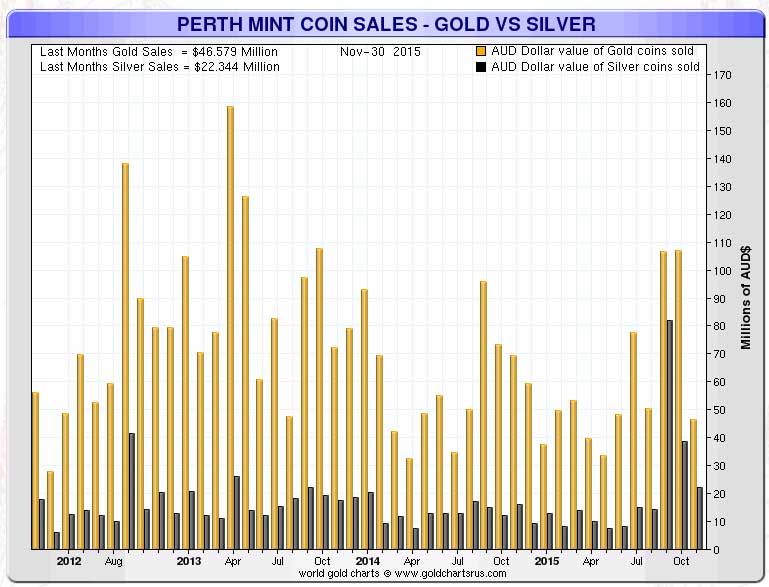

Now one could ask whether this silver explosion is a U.S. Mint specific phenomenon. So let’s check what is happening in the Australian Mint for instance, in the Perth Mint. The next chart shows gold and silver coin demand in the Perth Mint, but there are two important differences with the previous charts. First, the time period is much shorter, and, second, the bars represent dollar value (while above charts were about numbers of coins sold).

Although gold clearly outpaces silver in dollar value, which makes sense as the price of gold trades 70x higher than silver, a clear trend is visible: silver has truly outpaced gold since this summer, by far.

If anything, it is clear that “something” is going in with silver. Could it be that investors are worried about ongoing monetary and financial trends in this world? If this trend continues, we could be faced with a very interesting situation at a certain point in the future. As soon as precious metals prices will start rising again, and mainstream investment demand kicks in, we could finally see a shortage in the silver market, something that commentators are talking about for a long time.

In closing, let’s make one important point. Silver or gold demand are no leading indicators for the price of precious metals. It is rather a fundamental indicator. But an important one, that you better do not ignore!

Charts are courtesy of Sharelynx www.sharelynx.com