It was eight years ago that Lehman Brothers failed and the world tumbled into a tailspin, government and central banks responding with massive amounts of bailout money, stimulus, and ultra-low interest rates.

At a moment when the world has exhausted their stimulus efforts, a massive recession is due, and a Deutsche Bank failure could be the very thing that knocks down the house of cards. Really, it could have been any sort of imbalance that bursts in the system, such as high unemployment, credit defaults, stock market panic, countries ditching the dollar, real estate collapse, etc… However, it really seems as if the largest, most reckless bank in Europe might very well be what sends the economy into a tailspin. October could go down in history as another crashing month for the markets in 2016.

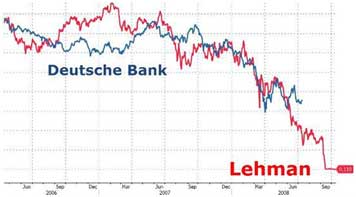

Zero Hedge has had some fun compiling some very similar patterns of data between Deutsche Bank and Lehman Brothers, as they both are headed down the same trajectory.

And here it is after the most recent headlines:

Shares in Germany’s biggest lender, Deutsche Bank, plummeted on the Frankfurt stock market on Friday, dragging other European banks and global markets down with it after reports said some customers were pulling money out.

“Everyone is hypersensitive,” said one hedge fund manager caught out by the Lehman collapse. “Lehman’s taught everyone that there’s very little upside in keeping your exposure.”

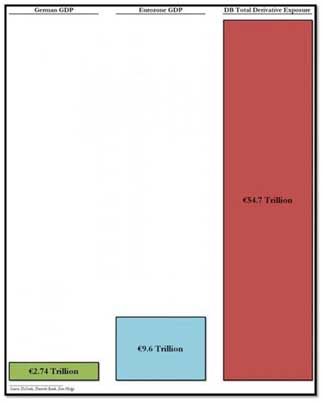

Interestingly enough, Germany is not known for reckless and idiotic things in the financial markets, but the country’s largest bank is causing nightmares for global policy makers and investors. But it really goes to show how far gone the system has become. The fact is Deutsche Bank has engaged in activities so careless it would cause management at Lehman to raise their brow. Their derivatives exposure is not only larger than German GDP, it’s larger than the GDP of the entire continent.

Just to throw it in, Deutsche Bank even racked up $14 billion in fines for mortgage fraud, which is a drop in the bucket compared to the trillions on their derivatives book, but a sign of their egregious behavior.

In my opinion, if and WHEN DB goes under, there will certainly be a central planning attempt to rescue them, even though there is talk about not coming to their rescue.

Chancellor Merkel has been recorded in saying no rescue is planned for the bank. Of course, that was said while the bank was not in a state of panic. But also consider what will happen when equity holders are getting wiped out and the chain reaction of the collapse starts to set in… You can bet that state aid will be applied. And either way, whether the implosion happens now or the bubble inflates more aggressively, a massive reset is coming.

The end game of government and central bank lunacy is surely near, because failures will overwhelm their control.

As for all of you, keep in mind conventional actions will not work under unconventional circumstances…