A couple of weeks ago, President Obama mocked Republicans, saying they are “down on America.” He cherry-picked things such as the fictitious job growth and how more Americans are now covered with health insurance, which he touts is actually hitting record highs. He mocks anyone who is opposing his leadership, and implies the doom-and-gloom predictions of his political enemies are looking ever more at odds with reality.

The reality is if you gave me trillions of dollars to spend, I would guarantee everyone a good time for now, and the lives of some would undoubtedly go up, at least in the short-term.

This whole illusion of a thriving economy is built on debt. When you finance something that doesn’t create value, you are living better now and sacrificing quality of life in the future. When you save, you are deferring gratification until a later date, where it can then be fully enjoyed. This is a concept that has been lost with governments all around the world.

There are an estimated $1 quadrillion-plus in derivatives that have created an illusion of wealth in our global economy that is backed by debt and easy money. The Federal Reserve has created a situation where easy money has created insane bubbles throughout our economy and other economies around the world.

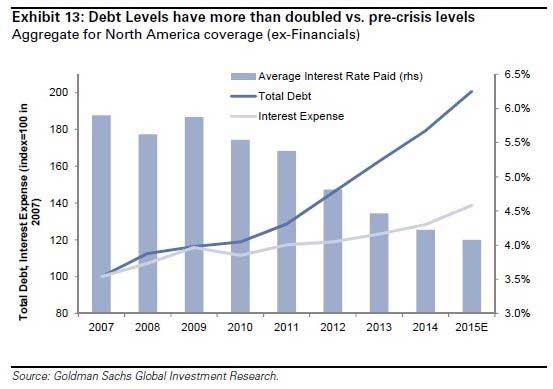

Goldman Sachs just put out some alarming analyses that show how inflated our economy has become. Goldman analysts, led by Robert Boroujerdi, wrote in the note, “Companies in the United States have taken advantage of low interest rates to issue record levels of debt over the past few years to fund buybacks and M&A… This has driven the total amount of debt on balance sheets to more than double pre-crisis levels.” Pre-crisis levels imply to me, at least, that we are at levels that should be alarming to those who can be affected by this.

Not only are corporate balance sheets inflated with debt, they are inflated in another area, referred to as goodwill. Goodwill is a premium that is paid for another when it is acquired. This has happened a lot; considering there has been so much cheap money for companies to borrow, mergers and acquisitions have been rampant over the last few years. This actually shows up as an asset on the balance sheet, which is continuing to balloon with ultra-low rates and this expectation that the economy is going to continue to thrive and grow indefinitely. Goldman estimates $1 trillion in goodwill has been added to corporate balance sheets since 2008, which means that there is a lot of manufactured wealth floating around that could quickly vanish in a credit crunch situation.

Not only are corporate balance sheets inflated with debt, they are inflated in another area, referred to as goodwill. Goodwill is a premium that is paid for another when it is acquired. This has happened a lot; considering there has been so much cheap money for companies to borrow, mergers and acquisitions have been rampant over the last few years. This actually shows up as an asset on the balance sheet, which is continuing to balloon with ultra-low rates and this expectation that the economy is going to continue to thrive and grow indefinitely. Goldman estimates $1 trillion in goodwill has been added to corporate balance sheets since 2008, which means that there is a lot of manufactured wealth floating around that could quickly vanish in a credit crunch situation.

Take a moment to make sure you are living within your means, pay off your debts, and own real value. With what is looking likely to be a false rally in the precious metals arena, you might consider taking this as a blessing to purchase some real, tangible assets that are once again trading at very low valuations.

The phenomenon of perceived wealth is something that builds momentum and perpetuates bubbles in all markets. As valuations of “assets” rise, people spend and borrow based on this perceived wealth until one day there is a credit crunch. It’s at this time the perceived wealth vanishes and only real value is what is left standing.

With markets manipulated more than ever, the potential for a collapse in perceived wealth is a very real threat to the global economy.

Take action today!